When it comes to making investment decisions, rationality should be the guiding principle. However, research in behavioral finance has revealed that human emotions often drive our financial choices, leading to suboptimal outcomes. In this article, we will explore the concept of rational investment choices and how behavioral factors can affect our decision-making process.

Having a clear investment strategy and a well-diversified portfolio are crucial elements of successful financial planning. Long-term investments require careful consideration of various factors, such as asset allocation, risk management, and wealth management. By understanding the impact of behavioral biases, we can make more informed and rational investment decisions.

In this section, we will delve into the truth about investor behavior and the factors that influence our investment choices. We will also discuss the impact of color psychology on investment decisions and how it can affect our perception of market prices. Furthermore, we will explore the connection between trading psychology and behavioral finance in the world of cryptocurrency trading.

Key Takeaways:

- Rational investment choices are essential for successful financial planning.

- Understanding behavioral factors can help us make more informed decisions.

- The impact of color psychology on investment decisions should not be overlooked.

- Behavioral finance concepts apply to cryptocurrency trading as well.

- Mitigating biases is crucial for rational trading and achieving successful outcomes.

Questioning Rational Actor Theory

The rational actor theory assumes that individuals make investment choices based on complete information and error-free calculations. According to this theory, market participants are rational actors who carefully consider all available data and make rational decisions that align with their best interests. However, behavioral finance challenges this assumption and provides evidence that rational behavior is not prevalent in investment choices.

Behavioral finance combines insights from cognitive psychology and economics to understand how human emotions and cognitive biases influence financial decision-making. It highlights the role of emotions in shaping investors’ behavior and how these emotional responses can lead to suboptimal investment decisions.

Investors’ decisions are often driven by fear, greed, and overconfidence, which can cloud their judgment and derail their investment strategies. For example, investors may hold onto losing stocks in the hope of a rebound, even when it goes against rational decision-making. This behavior is known as the “disposition effect,” where investors are reluctant to realize losses and tend to sell their winning stocks too quickly. Such biases can undermine the effectiveness of traditional models that assume rational behavior.

Behavioral finance challenges the assumption of rational actor theory, highlighting the importance of understanding and managing emotional and cognitive biases in investment choices.

In addition to emotional biases, investors also face cognitive biases such as anchoring, confirmation bias, and overconfidence. These biases can lead investors to rely too heavily on recent market trends, selectively interpret information that confirms their preexisting beliefs, and overestimate their own abilities, respectively.

The efficient market hypothesis, which assumes that market prices reflect all available information and are therefore always correct, is also questioned by behavioral finance. Behavioral economists argue that markets are not always efficient, as investors often exhibit irrational behavior that results in mispricing and market inefficiencies.

Understanding the limitations of rational actor theory and recognizing the influence of emotions and cognitive biases on investment choices is crucial for effective risk management and overall investment success. By incorporating insights from behavioral finance and implementing strategies to mitigate biases, such as diversification and disciplined decision-making, investors can make more informed and rational investment decisions.

Examples of Cognitive Biases in Investment Decisions

| Cognitive Bias | Description | Impact on Investment Decisions |

|---|---|---|

| Anchoring Bias | Relying too heavily on a reference point or initial information | Investors may anchor their expectations to past prices, leading to inappropriate valuations |

| Confirmation Bias | Seeking information that confirms preexisting beliefs | Investors may selectively interpret information, ignoring contradictory evidence |

| Overconfidence Bias | Overestimating one’s abilities and the accuracy of predictions | Investors may take on excessive risks or make overly optimistic forecasts |

The Truth About Investor Behavior

Dalbar’s “Quantitative Analysis of Investor Behavior” study provides valuable insights into the behavior of average investors and their performance in equity mutual funds and fixed income mutual funds compared to market indices. The results of this study challenge the assumption of rational behavior in investment choices.

According to Dalbar’s study, equity mutual fund investors consistently underperform the S&P 500 by a significant margin. This underperformance suggests that average investors fail to achieve market-index returns in their investment portfolios. Similarly, fixed income mutual fund investors also consistently underperform the benchmark bond market index.

These findings raise questions about the investment decisions made by average investors and their ability to achieve optimal returns. The evidence contradicts the notion of rational behavior and highlights the impact of behavioral biases on investor decision-making.

“The results of Dalbar’s study reveal a consistent pattern of underperformance among average investors in both equity mutual funds and fixed income mutual funds.”

This underperformance can be attributed to various behavioral biases, such as the tendency to chase past performance, herd mentality, and emotional decision-making. These biases erode the potential for earning market-level returns and suggest that investors are not always making rational choices.

Understanding investor behavior and the impact of behavioral biases is crucial for both investors and financial professionals. It emphasizes the importance of adopting a disciplined and rational investment approach, as well as implementing strategies to mitigate the negative effects of behavioral biases.

To gain a deeper understanding of investor behavior and its implications, let’s take a closer look at the specific factors and biases that influence investment decisions in the next section.

Average Investor Performance vs. Market Indices

| Investment Type | Performance Comparison |

|---|---|

| Equity Mutual Funds | Underperformance compared to the S&P 500 |

| Fixed Income Mutual Funds | Underperformance compared to the benchmark bond market index |

Behavioral Factors Affecting Investment Decisions

Investment decisions are influenced by various behavioral factors that can have a significant impact on investors’ choices and outcomes. Understanding these factors is crucial for making informed investment decisions and avoiding common pitfalls. Let’s explore some of the key behavioral factors that shape investment behavior.

Fear of Regret

Fear of regret is a powerful emotion that can drive investors to make suboptimal decisions. This fear often leads investors to hold onto losing investments in the hope of a turnaround, rather than cutting their losses. This behavior can create a vicious cycle of regret, as investors may continue to hold onto losing positions for longer than necessary, resulting in further losses.

Mental Accounting Behaviors

Mental accounting is the tendency for individuals to categorize their money into different mental accounts based on various factors. This can impact investment decision-making, as individuals may hesitate to sell an investment that has produced modest gains, viewing those gains as separate from the overall investment portfolio. This behavior can lead to missed opportunities and suboptimal financial outcomes.

Prospect Theory and Loss Aversion

Prospect theory suggests that individuals are more averse to losses than they are motivated by potential gains. This bias can impact risk-taking behavior in investment decisions. Investors tend to be more cautious and risk-averse when facing potential losses, which can lead to missed opportunities for growth. Understanding this bias can help investors calibrate their risk tolerance and make more balanced investment decisions.

Anchoring Behaviors

Anchoring is a cognitive bias that causes individuals to rely too heavily on specific information or reference points when making decisions. In the context of investments, anchoring can cause investors to place undue importance on recent market trends, leading to decision-making that may not align with long-term fundamentals. This behavior can result in missed opportunities or excessive risk-taking.

Over- and Under-reacting

Investors often exhibit tendencies to over- or under-react to market events, leading to irrational investment decisions. Overreacting to short-term market movements can result in impulsive buying or selling, driven by fear or greed. Conversely, under-reacting can cause investors to miss significant opportunities due to a lack of timely action. Finding a balanced and rational response to market events is crucial for successful investing.

Investor Overconfidence

Investor overconfidence is another behavioral factor that can significantly impact investment decisions. Overconfident investors tend to overestimate their abilities and underestimate risks, leading to poor investment choices and subpar performance. Recognizing and mitigating overconfidence can help investors make more realistic assessments and avoid unnecessary risks.

Social Factors

Social factors, such as peer pressure and social norms, can also influence investment decisions. Investors may be tempted to follow the crowd or make decisions based on the actions of others, rather than conducting independent research and analysis. Understanding the influence of social factors can help investors maintain objectivity and make more informed choices.

“Investment decisions are not solely driven by rational calculations. Behavioral factors play a significant role, shaping investor behavior and outcomes.”

| Behavioral Factors | Impact on Investment Decisions |

|---|---|

| Fear of Regret | Leads to holding onto losing investments |

| Mental Accounting Behaviors | Hesitation to sell investments with modest gains |

| Prospect Theory and Loss Aversion | Preference for avoiding losses over potential gains |

| Anchoring Behaviors | Relying heavily on recent market trends |

| Over- and Under-reacting | Impulsive buying or selling based on short-term market movements |

| Investor Overconfidence | Overestimating abilities and underestimating risks |

| Social Factors | Peer pressure and following the crowd |

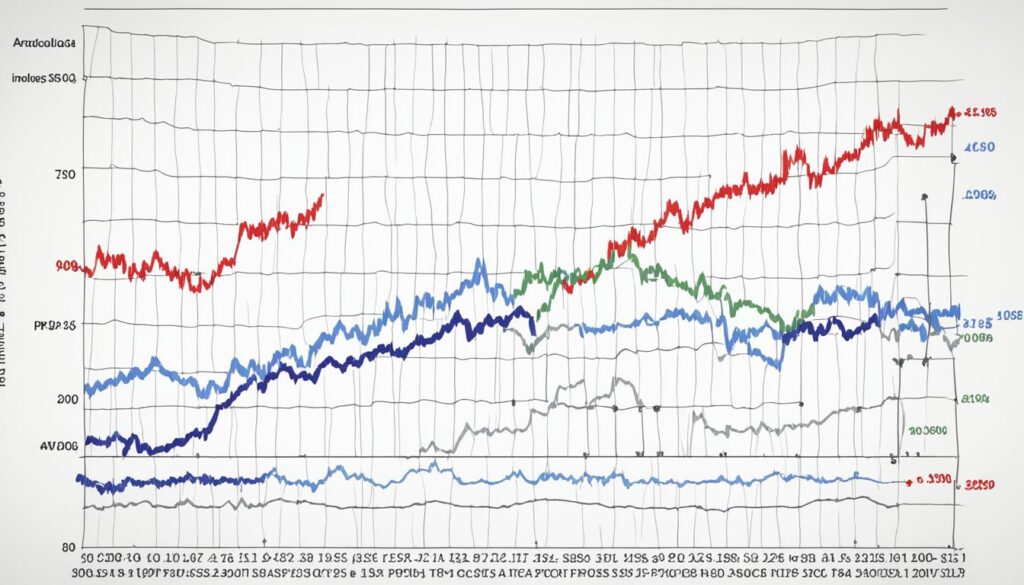

The Impact of Color on Investment Decisions

Color psychology plays a significant role in investors’ decision-making process. The colors used in financial information and market presentations can have a profound effect on how investors perceive and respond to the information presented. Understanding the impact of color on investment decisions is crucial for traders and investors seeking to make rational choices.

Confirmation bias, a cognitive bias that favors information confirming preexisting beliefs, can be influenced by the color in which the information is presented. When information is presented in a color that aligns with an investor’s preconceived notions or biases, they are more likely to interpret that information as supporting their initial beliefs. This can lead to a reinforcement of confirmation bias and potentially biased decision-making in the market.

For example, the color red, often associated with danger and warning signs, can evoke negative emotions and prolong pessimism in investors. If market prices or investment performance are presented in red, it can further amplify the negative emotions and reinforce investors’ pessimistic outlook. This can potentially impact their trading decisions and lead to suboptimal results.

“Investors should be mindful of how color influences their perception of information. Being aware of the potential biases that can arise from color presentations can help traders make more rational and objective decisions in the market.” – Market Analyst, Jane Williams

Investors should be cautious about the use of color in market presentations and consider the potential impact it may have on their decision-making process. Striving for objective analysis and unbiased evaluation of information is essential for making rational trading decisions.

Color Psychology in Investment Data Visualization

Color psychology is also relevant in the context of investment data visualization. Different colors can be used to represent various data points or categories, enabling investors to interpret and analyze information more effectively.

When designing investment charts or graphs, consider using colors strategically to highlight key data and emphasize important trends or patterns. Use contrasting colors to differentiate between positive and negative performance, or use warm colors to draw attention to exceptional performance. These color choices can help investors process information quickly and intuitively.

| Color | Meaning | Usage |

|---|---|---|

| Green | Positive performance, growth | Representing rising stock prices, market gains |

| Red | Negative performance, decline | Representing falling stock prices, market losses |

| Blue | Stability, trust | Used for representing bond investments, safe assets |

| Yellow | Caution, warning | Highlighting risks or potential concerns |

By incorporating color psychology principles into investment data visualization, investors can enhance their understanding of market trends and make more informed decisions.

Trading Psychology and Behavioral Finance in Cryptocurrency Trading

Cryptocurrency trading is not immune to the influence of trading psychology and behavioral finance. Traders in the cryptocurrency market are subject to the same psychological biases as investors in traditional financial markets. These biases can significantly impact trading decisions and overall portfolio performance.

One of the psychological biases at play in cryptocurrency trading is the availability heuristic. This bias occurs when traders rely on readily available information, such as recent news or trends, to make decisions. For example, if a trader sees multiple positive news articles about a specific cryptocurrency, they may assume that it is a good investment without conducting thorough research.

Confirmation bias is another psychological bias that affects cryptocurrency traders. This bias occurs when traders seek out information that confirms their existing beliefs and ignore information that contradicts them. For instance, a trader who believes that a particular cryptocurrency will increase in value may only focus on positive news and overlook potential risks.

The bandwagon effect is also prevalent in cryptocurrency trading. This bias occurs when traders follow the crowd and invest based on the actions of others, rather than conducting independent research. If a cryptocurrency is experiencing a significant increase in value, traders may feel the pressure to join the trend, even if it goes against their better judgment.

“The cryptocurrency market is highly volatile, and traders may fall victim to irrational decision-making due to psychological biases.” – Crypto Trading Expert

Loss aversion is a psychological bias that can greatly impact cryptocurrency traders. Traders may be more averse to potential losses than they are attracted to potential gains. This bias can lead to holding onto losing investments for longer than necessary, hoping that they will eventually turn around.

Overconfidence is yet another psychological bias that can hinder cryptocurrency traders. Traders may overestimate their abilities and knowledge, leading them to take on excessive risk or make impulsive trading decisions without proper analysis. Overconfidence can lead to significant losses in the cryptocurrency market.

To mitigate the impact of these psychological biases, cryptocurrency traders should adopt a diversified and long-term investment strategy. Diversification helps reduce the influence of individual biases on the overall portfolio by spreading investments across different cryptocurrencies. Additionally, taking a long-term perspective helps traders avoid making impulsive decisions based on short-term market fluctuations.

| Psychological Biases | Impact on Cryptocurrency Trading |

|---|---|

| Availability Heuristic | Traders may rely on recent news and trends instead of conducting thorough research. |

| Confirmation Bias | Traders may selectively seek out information that confirms their existing beliefs. |

| Bandwagon Effect | Traders may follow the crowd and invest based on the actions of others. |

| Loss Aversion | Traders may hold onto losing investments for longer than necessary. |

| Overconfidence | Traders may take on excessive risk or make impulsive trading decisions. |

By understanding and being aware of these psychological biases, cryptocurrency traders can make more rational decisions and improve their overall trading outcomes. It is crucial to remain disciplined, conduct thorough research, and avoid succumbing to emotional impulses when trading in the cryptocurrency market.

Strategies to Mitigate Psychological Biases in Trading

To successfully navigate the complex world of trading, it is crucial to recognize and mitigate the influence of psychological biases. By understanding the impact of biases such as confirmation bias, bandwagon effect, loss aversion, and overconfidence, traders can make more rational and informed decisions.

Gathering Information from Multiple Sources

One way to counteract biases is by seeking information from various sources. Relying solely on a single information outlet can lead to confirmation bias, where traders only consider data that confirms their existing beliefs. By diversifying the sources of information, traders can gain a broader perspective and reduce the likelihood of biased decision-making.

Maintaining a Trading Journal

A trading journal can serve as a powerful self-reflection tool. By documenting trading decisions, emotions, and outcomes, traders can identify patterns and biases in their own behavior. This self-awareness allows for more objective analysis and helps in avoiding the repetition of past mistakes.

Avoiding Herd Mentality

The bandwagon effect, where individuals follow the actions of the majority, can lead to irrational trading decisions. Traders should be cautious of herd mentality and avoid making decisions solely based on the actions of others. Conducting thorough research and analysis is crucial in developing an independent viewpoint.

Setting Realistic Risk Limits

Loss aversion bias can cause traders to hold on to losing trades for too long, hoping that they will eventually turn profitable. Setting realistic and predetermined risk limits helps in controlling emotions and making rational decisions. Traders should define their risk tolerance before entering trades and stick to these limits, even when emotions may tempt them to deviate.

Staying Focused on Long-Term Goals

Overconfidence can lead traders to engage in impulsive and risky trading behaviors. By staying focused on long-term goals, traders can resist the urge for short-term gains and make rational decisions that align with their overall investment strategy. Patience and discipline are essential in avoiding the pitfalls of overconfidence.

By implementing these strategies, traders can mitigate the influence of psychological biases and strive for more rational trading. Recognizing the existence of biases, actively countering them, and maintaining a disciplined approach are essential steps towards achieving success in the dynamic world of trading.

Are Crypto Investments Considered Rational Choices for Investors?

Many investors are eager to uncover crypto investment secrets revealed to assess whether crypto investments are rational choices. With the potential for high returns and the volatility of the market, it’s essential to weigh the risks and benefits before diving into the world of cryptocurrency.

Conclusion

Rational investment choices are a key factor in achieving financial success. Understanding the influence of behavioral finance and trading psychology allows investors to make informed decisions and mitigate the impact of biases. By questioning assumptions and being aware of the psychological factors at play, investors can navigate the complex world of finance more effectively.

One effective strategy for mitigating biases is diversifying investment portfolios. By spreading investments across different asset classes and industries, investors can reduce the impact of market volatility on their overall returns. Additionally, setting realistic risk limits ensures that investors do not expose themselves to undue risk, allowing for a more balanced and rational approach to investing.

Staying focused on long-term goals is another crucial aspect of rational investment choices. It is important to resist the temptation to make impulsive trading decisions based on short-term market fluctuations. Instead, by maintaining a long-term perspective and sticking to a well-defined investment strategy, investors can avoid succumbing to emotional biases and maximize the potential for long-term growth.

FAQ

What is rational actor theory and how does it relate to investment choices?

Rational actor theory assumes individuals make rational choices based on complete information and error-free calculations. It is commonly used in financial theory to explain investment decisions. However, behavioral finance challenges this theory, providing evidence that rational behavior is not prevalent in investment choices.

What evidence suggests that average investors do not make rational investment choices?

The “Quantitative Analysis of Investor Behavior” study conducted by Dalbar consistently shows that average investors underperform market indices. Equity mutual fund investors underperform the S&P 500, while fixed income mutual fund investors also consistently underperform the benchmark bond market index. This indicates that irrational behavior is prevalent in investment choices.

What are some behavioral factors that influence investment decisions?

There are several behavioral factors that impact investment decisions. Fear of regret can lead investors to hold onto losing stocks, creating a cycle of regret. Mental accounting behaviors can cause hesitation when selling investments with modest gains. Prospect theory shows that people are more averse to losses than gains, impacting risk-taking behavior. Anchoring behaviors can cause investors to rely too heavily on recent market trends. Over- and under-reacting to market events is also common among investors. Investor overconfidence and social factors can also influence decision-making.

How does color psychology impact investment decisions?

Color psychology plays a significant role in investor decisions. The color red, associated with danger and warning signs, can evoke negative emotions and prolong pessimism in investors. Confirmation bias, a cognitive bias that favors information confirming preexisting beliefs, can be influenced by the color in which information is presented. Understanding the impact of color on investment decisions can help investors make more rational choices.

How does behavioral finance apply to cryptocurrency trading?

Behavioral finance concepts and trading psychology are highly relevant to cryptocurrency trading. Traders’ decisions are influenced by psychological biases such as availability heuristic, confirmation bias, bandwagon effect, loss aversion, and overconfidence. Understanding these biases can help traders make more rational decisions. Diversification and long-term investment strategies are important in mitigating the impact of psychological biases.

What are some strategies to mitigate psychological biases in trading?

To reduce the influence of psychological biases in trading, it is essential to acknowledge their existence and take steps to counteract them. This includes gathering information from multiple sources, maintaining a trading journal for self-reflection, avoiding herd mentality, setting realistic risk limits, and staying focused on long-term goals. Rational trading requires recognizing and mitigating the influence of psychological biases.

How can investors make rational investment choices?

Rational investment choices require understanding the influence of behavioral finance and trading psychology. Investors can mitigate the impact of biases by questioning assumptions, diversifying portfolios, setting realistic risk limits, and staying focused on long-term goals. By making informed decisions and reducing the influence of psychological biases, investors can improve their chances of achieving successful outcomes in the financial markets.