When it comes to making financial decisions, it’s crucial to separate fact from fiction. One fallacy that often clouds judgement is the Gambler’s Fallacy, also known as the Monte Carlo fallacy. This mistaken belief suggests that the likelihood of a certain random event occurring is influenced by the outcome of previous events. In the realm of financial advising, this fallacy can lead investors astray by luring them into making decisions based on past performance rather than independent analysis.

Key Takeaways:

- Understanding the Gambler’s Fallacy is essential in avoiding financial pitfalls.

- Each event should be considered independent, with no bearing on future outcomes.

- Investors can avoid the fallacy by following a trading system based on independent research.

- The famous example at the Casino de Monte-Carlo serves as a cautionary tale.

- The fallacy can impact investors through anchoring, trend-following, and herding behavior.

Understanding the Gambler’s Fallacy

The Gambler’s Fallacy is a common cognitive bias that can affect decision-making in various fields, including finance. It occurs when individuals mistakenly believe that a series of events is not truly random and that future outcomes are influenced by past results. One classic example of the Gambler’s Fallacy is the belief that if a fair coin has landed on heads multiple times in a row, the next flip is more likely to be tails.

This misconception arises from a misunderstanding of probability. Each coin flip is an independent event with a 50% chance of landing on either heads or tails. The outcome of one flip does not affect the outcome of subsequent flips. Therefore, even if a fair coin has landed on heads ten times in a row, the probability of it landing on tails remains 50% on the next flip.

Traders and investors can fall victim to the Gambler’s Fallacy when making financial decisions. They may erroneously believe that past performance of a stock or market can predict future performance. However, it is important to recognize that each investment is an independent event and that past performance does not guarantee future success.

To avoid the Gambler’s Fallacy, traders and investors should adopt a trading system based on independent research and analysis rather than relying solely on past results. By following a well-defined investment strategy and tracking their behavior before and after trades, individuals can make more informed decisions and minimize the influence of this cognitive bias.

Examples of the Gambler’s Fallacy

One famous illustration of the Gambler’s Fallacy took place at the Casino de Monte-Carlo in 1913. After the roulette wheel had landed on black numerous times in a row, many people started betting on red, assuming it was more likely to occur. However, the fallacy became apparent when it took 26 turns for the ball to finally land on red.

In the realm of investing, the Gambler’s Fallacy can manifest when individuals believe that a stock’s future direction will reverse based on its past performance. This can lead to poor investment decisions and substantial losses. It is crucial for investors to recognize the Gambler’s Fallacy and make decisions based on thorough research and analysis rather than relying on this faulty belief.

Examples of the Gambler’s Fallacy

One famous example of the Gambler’s Fallacy occurred at the Casino de Monte-Carlo in 1913. After the roulette wheel had landed on black several times in a row, people started betting on red because they believed it was more likely to occur. However, the fallacy was exposed when it took 26 turns for the ball to finally land on red. This incident illustrates how the Gambler’s Fallacy can lead individuals to make irrational decisions based on false assumptions about probability.

In the world of investing, the Gambler’s Fallacy often manifests when investors believe that a stock’s future performance can be predicted based on its past performance. For example, if a stock has been consistently increasing in value for several months, some investors may assume that it is due for a decline and decide to sell. This belief is based on the incorrect assumption that the stock’s past performance has any influence on its future trajectory. In reality, stock performance is influenced by a multitude of complex factors and cannot be accurately predicted based on past data alone.

“The Gambler’s Fallacy is a dangerous trap that investors can fall into. It can lead to poor decision-making and significant financial losses. It’s important for investors to understand that each investment is an independent event, and past performance does not guarantee future results.”

Table: Comparing Stock Performance

| Stock | Past Year Returns | Next Year Returns |

|---|---|---|

| ABC Corp | +20% | +10% |

| XYZ Inc | +15% | +12% |

The table above compares the past year returns of two stocks, ABC Corp and XYZ Inc. Despite ABC Corp having a higher past year return, it does not necessarily mean that it will outperform XYZ Inc in the next year. The Gambler’s Fallacy would suggest that ABC Corp is more likely to have a lower return due to its previous success, but in reality, stock performance is influenced by many unpredictable factors. Investors should avoid falling into the trap of the Gambler’s Fallacy and instead make investment decisions based on comprehensive research, analysis, and a well-diversified portfolio.

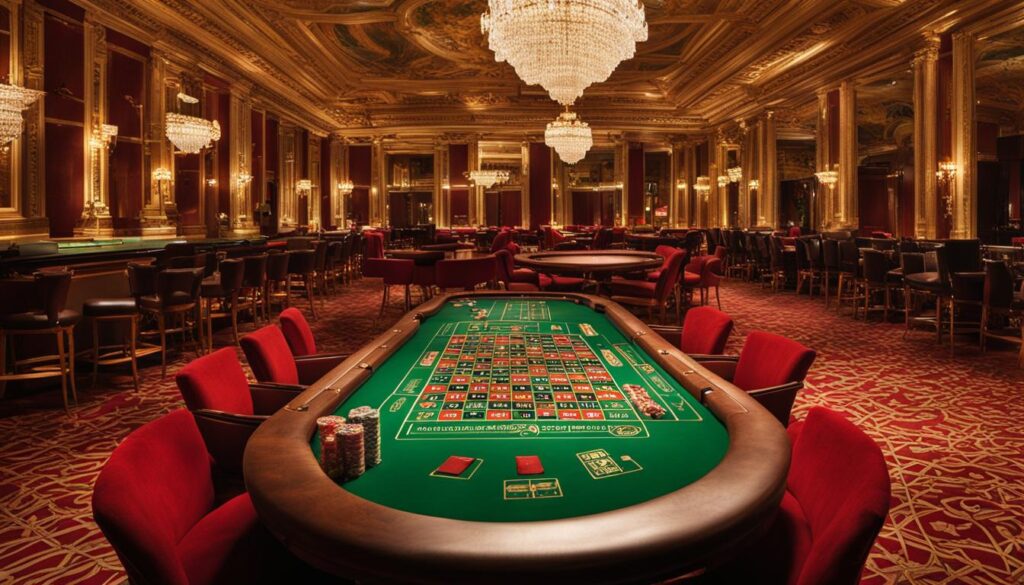

The image above depicts the iconic Casino de Monte-Carlo, where the Gambler’s Fallacy gained prominence. It serves as a reminder of the irrationality that can arise from basing decisions on false assumptions about probability.

How the Gambler’s Fallacy Impacts Investors

The Gambler’s Fallacy can have a significant impact on investors and their decision-making process. One way this fallacy manifests is through the temptation to chase hot stocks. Investors may believe that a stock’s past performance is an indication of future gains, leading them to invest in a stock solely based on its recent positive performance. However, it is important to remember that the stock market is unpredictable, and past performance does not guarantee future success.

Another way the Gambler’s Fallacy affects investors is through anchoring. Anchoring refers to the reliance on past prices when making investment decisions. Investors may hold onto outdated information, such as a stock’s previous high price, and base their decisions on that. This can lead to missed opportunities or holding onto underperforming stocks for too long.

Trend-following and herding behavior are also manifestations of the Gambler’s Fallacy. Investors may believe that past trends will continue indefinitely and make decisions based on what others are doing. This herd mentality can lead to irrational investment choices and a lack of independent thinking.

Examples of the Gambler’s Fallacy Impacting Investors

- An investor sees that a particular stock has consistently performed well over the past few months. They believe that the stock will continue to rise and invest a large amount of money in it. However, shortly after their investment, the stock experiences a significant drop, causing them to suffer substantial losses. This is an example of the Gambler’s Fallacy in action, as the investor incorrectly assumed that the stock’s past performance guaranteed future success.

- A group of investors notice that many people are buying shares of a particular company due to its recent success. They decide to follow the trend and invest in the stock as well, believing that they can ride the wave of success. Unfortunately, the stock’s performance eventually declines, and the investors suffer losses. This is an example of herding behavior influenced by the Gambler’s Fallacy.

To avoid falling victim to the Gambler’s Fallacy, investors should conduct thorough research, maintain a diversified portfolio, stick to an investment strategy, be patient, and seek professional advice when needed. By avoiding the traps of anchoring, trend-following, and herding behavior, investors can make more informed decisions and achieve greater long-term success.

| Impact of the Gambler’s Fallacy | Examples |

|---|---|

| Chasing hot stocks | Investing in a stock solely based on its recent positive performance |

| Anchoring | Reliance on past prices when making investment decisions |

| Trend-following and herding behavior | Making investment choices based on past trends and the actions of others |

Conclusion

The Gambler’s Fallacy is a common behavioral bias that can significantly impact financial decision-making. By understanding and recognizing this fallacy, investors can make more informed choices and avoid potential pitfalls.

To overcome the Gambler’s Fallacy, it is crucial for investors to base their decisions on objective research and analysis rather than relying on past events. This can be achieved by conducting thorough due diligence, considering multiple factors, and seeking professional advice when needed.

Additionally, maintaining a diversified portfolio and following a well-defined investment strategy can help reduce the influence of the Gambler’s Fallacy. By spreading investments across different asset classes and sectors, investors can mitigate the risks associated with relying solely on past performance.

Ultimately, financial decision-making should be driven by sound judgment and rational thinking rather than succumbing to behavioral biases such as the Gambler’s Fallacy. By remaining aware of these biases and implementing strategies to overcome them, investors can navigate the markets with greater confidence and increase their chances of achieving long-term success.

FAQ

What is the Gambler’s Fallacy?

The Gambler’s Fallacy is the incorrect belief that a certain random event is more or less likely to occur based on the outcome of previous events.

How does the Gambler’s Fallacy occur?

The Gambler’s Fallacy occurs when individuals misjudge whether a series of events is truly random and independent.

Can you give an example of the Gambler’s Fallacy in action?

One famous example is when people at the Casino de Monte-Carlo in 1913 started betting on red after the roulette wheel had landed on black several times in a row.

How does the Gambler’s Fallacy impact investors?

The Gambler’s Fallacy can lead investors to chase hot stocks, rely on past prices, follow trends, and make decisions based on the actions of others.

How can investors avoid falling victim to the Gambler’s Fallacy?

Investors can avoid the Gambler’s Fallacy by conducting thorough research, maintaining a diversified portfolio, sticking to an investment strategy, being patient, and seeking professional advice when needed.

How Does the Gambler’s Fallacy Apply to Behavioral Economics?

In analyzing behavioral economics, it is crucial to examine the impact of the gambler’s fallacy. This fallacy refers to the mistaken belief that past events can influence future outcomes in random processes. In the field of behavioral economics, individuals may exhibit this bias by assuming that if they have experienced a series of losses, a win is imminent. Recognizing and understanding the gambler’s fallacy in behavioral economics is essential to combat irrational decision-making based on faulty assumptions.

Pingback: Betting on the Wrong Horse: The Gambler’s Fallacy in Finance – Straight Fire Money