Imagine this: You’re on a dream vacation in a remote part of Thailand, basking in the sun and enjoying the vibrant culture. Suddenly, you slip on a wet floor and injure your ankle. The local clinic demands upfront payment for treatment, and your travel insurance has a high deductible. Without an emergency fund, you’re left scrambling to cover the unexpected costs, turning a perfect holiday into a financial nightmare. This scenario highlights why an emergency fund for vacations is essential. Don’t let unforeseen expenses ruin your trip—be prepared and enjoy peace of mind knowing you’re financially secure.

Building an emergency fund is crucial for a stress-free vacation. Having a financial safety net can help you handle unexpected expenses and ensure that your trip goes smoothly. Here are some tips on setting aside an emergency fund for your next vacation, based on expert advice from personal finance sources.

Key Takeaways:

- Creating an emergency fund is essential to handle unexpected expenses during your vacation.

- An emergency fund acts as a safety net to prevent you from going into debt or relying on credit cards or loans.

- Start building your emergency fund by setting a savings goal and regularly setting aside a designated amount of money.

- Consider factors like transportation, accommodation, food, and activities when budgeting for your vacation.

- Striking a balance between enjoying your vacation and prioritizing financial security is crucial.

Why You Need an Emergency Fund for Vacations

- Peace of Mind: Knowing you have a safety net allows you to enjoy your vacation without financial worries.

- Unexpected Costs: From medical emergencies to last-minute itinerary changes, having a fund covers unplanned expenses.

- Prevention of debt or reliance on credit: Returning from what should have been the perfect holiday with unforeseen credit card debt that takes years to repay can be disastrous.

An emergency fund is a crucial component of financial planning, providing a safety net for unexpected expenses. It serves as a buffer to protect you from the financial stress of emergencies such as car repairs, medical bills, or sudden unemployment. By having an emergency fund, you can avoid going into debt or relying on credit cards to cover unforeseen costs.

Having a robust emergency fund is especially important when planning a vacation. Travel can come with its own set of unexpected expenses, such as flight cancellations, lost luggage, or last-minute accommodation changes. These unplanned costs can quickly add up and derail your vacation experience.

By setting aside money specifically for emergencies, you can approach your vacation with peace of mind. Whether it’s purchasing travel insurance or covering the cost of a medical emergency abroad, having an emergency fund ensures that you are financially prepared for any unforeseen circumstances that may arise. It allows you to focus on enjoying your trip without worrying about the impact of unexpected expenses on your overall financial well-being.

So, how much should you save in your emergency fund? Financial experts recommend aiming for three to six months’ worth of living expenses. This amount provides a significant safety net and can help you navigate unforeseen challenges without compromising other financial goals. It’s important to remember that everyone’s situation is unique, so consider factors such as your monthly expenses, job stability, and lifestyle when determining your savings goal.

“An emergency fund provides peace of mind and acts as a safety net to protect you from the unexpected. It is an essential part of a sound financial plan, ensuring that you can handle unforeseen expenses without derailing your vacation or future goals.” – Financial Expert

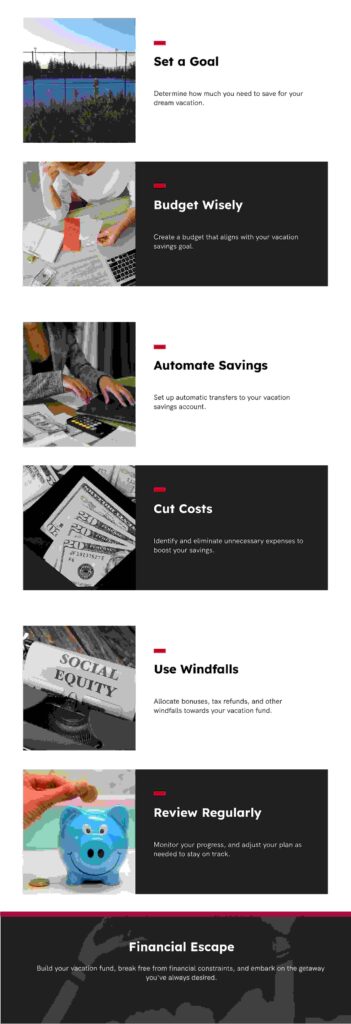

How to Build Your Emergency Fund in 6 Steps

Building an emergency fund requires careful financial planning. By following these steps, you can start setting aside money for unexpected expenses and create financial security for your vacations.

- Set a Goal

– Determine how much you need based on your travel plans and potential emergencies. Consider costs like medical emergencies, lost luggage, or extended stays due to unforeseen circumstances. - Create a Budget

– Analyze your current finances to identify how much you can save each month. Track your income and expenses to find areas where you can cut back. Use budgeting apps to simplify this process. - Automate Savings

– Set up automatic transfers to your emergency fund to ensure consistent contributions. For example, some banks allow you to round up your purchases to the nearest dollar and save the difference automatically. - Cut Unnecessary Expenses

– Identify and reduce non-essential spending to boost your savings. This could mean dining out less, canceling unused subscriptions, or finding cheaper alternatives for daily expenses. - Use Windfalls Wisely

– Allocate any unexpected money, like tax refunds or bonuses, to your emergency fund. This can significantly boost your savings without affecting your regular budget. - Review and Adjust Regularly

– Periodically review your emergency fund to ensure it aligns with your travel plans and financial situation. Adjust your savings goals and strategies as needed to stay on track.

By following these steps and staying disciplined with your savings, you can build an emergency fund that provides a safety net for unexpected expenses during your vacations. With careful financial planning, you can enjoy your travels without worrying about financial setbacks.

Tips for Maintaining Your Fund

Regularly Review and Adjust

Periodically assess your fund to ensure it meets your needs. Adjust your savings goal as your travel plans or financial situation changes.Keep it Accessible but Separate

Make sure your emergency fund is easily accessible during your travels but not so easily that you might dip into it for non-emergencies. Consider using a separate savings account dedicated to this fund.Stay Committed

Treat your emergency fund as a non-negotiable part of your budget. Consistency is key to building a reliable safety net.

Recommended Saving Levels for a Vacation Emergency Fund

To ensure you’re adequately prepared for any emergency that might arise during your vacation, consider saving a percentage of your total trip expenses. Here are three recommended saving levels:

Basic Safety Net (10-15% of Trip Expenses)

- This level is suitable if you’re generally confident about your trip plans and have other safety nets like travel insurance. It covers minor unexpected costs, such as small medical expenses or minor travel delays.

Moderate Safety Net (20-30% of Trip Expenses)

- This level is ideal if you want to be more cautious. It provides a more substantial buffer for moderate emergencies, such as significant travel delays, lost luggage, or medical emergencies that require a visit to a clinic or hospital.

Comprehensive Safety Net (40-50% of Trip Expenses)

- For those who prefer to be fully prepared, this level covers major emergencies, such as extended stays due to illness, major medical emergencies, or significant travel disruptions. This ensures you have enough funds to handle most unexpected situations without stress.

Example Calculation:

- If your total trip expenses are $3,000:

- Basic Safety Net: $300 – $450

- Moderate Safety Net: $600 – $900

- Comprehensive Safety Net: $1,200 – $1,500

Factors to Consider for Vacation Budgeting

When planning your vacation budget, it’s important to consider various factors to ensure you can make the most of your trip without overspending. By carefully analyzing and managing your expenses, you can stretch your budget and have a memorable vacation within your means. Here are some key factors to consider when budgeting for your next getaway:

Transportation Costs

Transportation expenses can significantly impact your vacation budget. Whether you’re flying, driving, or taking public transportation, it’s crucial to research and compare prices to find the most cost-effective option. Consider using travel rewards points or miles to offset some of the costs, or explore alternative transportation methods to save money.

Accommodation Expenses

Choosing the right accommodation can make a significant difference in your vacation budget. Compare prices and look for deals or discounts, and consider alternatives to traditional hotels, such as vacation rentals or hostels. Prioritize your needs and preferences, and aim for a balance between comfort and affordability.

Food and Dining

Eating out can be a major expense during your vacation. To save money, consider packing snacks or light meals for day trips, and opt for local eateries or street food instead of high-end restaurants. You can also save by researching and taking advantage of happy hours, lunch specials, or dining coupons in your destination.

Activities and Entertainment

Plan your activities and entertainment in advance to avoid overspending. Look for free or low-cost attractions, explore nature or public parks, or take advantage of discounted tickets or group rates. Consider prioritizing the experiences that matter most to you and allocate your budget accordingly.

| Factors to Consider for Vacation Budgeting | Considerations |

|---|---|

| Transportation Costs | Compare prices, use travel rewards points, explore alternative transportation methods |

| Accommodation Expenses | Compare prices, look for deals or discounts, consider alternatives to traditional hotels |

| Food and Dining | Pack snacks or light meals, opt for local eateries or street food, take advantage of happy hours or dining coupons |

| Activities and Entertainment | Plan in advance, look for free or low-cost attractions, take advantage of discounted tickets or group rates |

Ensuring Remote Accessibility and Access in Other Countries

When traveling internationally, it’s crucial to ensure that your emergency fund is accessible remotely and in other countries. Here are some tips:

Choose the Right Bank

Opt for a bank that offers global access to your funds. Many international banks provide services that allow you to access your savings account from anywhere in the world through online banking and mobile apps.Use International Debit or Credit Cards

Ensure you have a debit or credit card linked to your emergency fund account that is widely accepted internationally. Inform your bank of your travel plans to avoid any issues with international transactions.Set Up Online Banking

Online banking allows you to manage your emergency fund remotely. Make sure you have online access to your account and that you know how to use it efficiently.Consider Multi-Currency Accounts

Some banks offer multi-currency accounts that can hold different currencies, reducing the need for currency exchange and minimizing fees.

Granting Access to a Trusted Person

In case you are unable to access your funds due to an emergency, having a trusted person who can access the account on your behalf is essential. Here’s how to set it up:

Designate a Trusted Person

Choose someone reliable, such as a close family member or friend, who can access your emergency fund if needed.Set Up Joint Account Access

Consider setting up a joint account with the trusted person or granting them limited access to your emergency fund account. Ensure that the account setup complies with your bank’s policies and provides the right level of access.Provide Necessary Documentation

Ensure your trusted person has the necessary documentation and information to access your funds, such as account numbers, bank contact information, and any required authorization forms.Use Power of Attorney

In some cases, granting power of attorney to your trusted person can be a secure way to allow them to manage your funds in emergencies. Consult with a legal advisor to set this up correctly.

The Importance of Prioritizing Financial Security

“Building emergency savings should always be a priority, even when planning for vacations. It’s important to have a safety net in place to protect yourself from unexpected expenses. By balancing your travel expenses with your emergency savings, you can have the best of both worlds – enjoying your vacation without compromising your financial security.” – Financial Expert

Emergency Savings vs. Insurance for Emergencies

While building an emergency fund is essential, having the right insurance can significantly reduce your financial risk, allowing you to lower the amount you need to save. Here’s how insurance complements your emergency fund:

Travel Insurance

Travel insurance can cover various unforeseen events, such as trip cancellations, lost luggage, and medical emergencies. By having travel insurance, you can reduce the amount you need in your emergency fund, as the insurance will cover many potential expenses.Health Insurance

Ensure your health insurance covers international travel or consider purchasing additional travel health insurance. This can cover medical emergencies abroad, reducing the need for a large emergency fund for medical expenses.Property Insurance

If you’re traveling with expensive items, such as electronics, make sure they are covered by your property insurance. This can protect against loss or damage, further reducing your financial risk.Auto Insurance

If you plan to drive during your vacation, check if your auto insurance covers international travel or rental cars. This can protect you from significant expenses in case of an accident.

Balancing Savings and Insurance

- Basic Safety Net with Insurance: If you have comprehensive travel and health insurance, you might opt for the Basic Safety Net (10-15% of trip expenses) as your insurance will cover most significant expenses.

- Moderate Safety Net with Limited Insurance: If your insurance coverage is limited, aim for the Moderate Safety Net (20-30% of trip expenses) to ensure you’re prepared for uncovered expenses.

- Comprehensive Safety Net with No Insurance: If you don’t have insurance, the Comprehensive Safety Net (40-50% of trip expenses) is recommended to cover all potential emergencies.

Case Study: Emily’s Emergency Fund Success Emily planned a dream vacation to Europe. She set a goal of saving $2,000 for emergencies. By automating her savings and cutting unnecessary expenses, she reached her goal in eight months. During her trip, she faced unexpected medical expenses but was able to handle them stress-free thanks to her emergency fund and travel insurance.

“Building emergency savings should always be a priority, even when planning for vacations. It’s important to have a safety net in place to protect yourself from unexpected expenses. By balancing your travel expenses with your emergency savings, you can have the best of both worlds – enjoying your vacation without compromising your financial security.” – Financial Expert

Conclusion

Start building your vacation emergency fund today to ensure a stress-free, enjoyable travel experience. With proper planning and the right insurance, you can handle any unexpected expenses that come your way. Begin by setting a goal, creating a budget, and staying committed to your savings plan.

With careful planning and mindful spending, you can have peace of mind knowing that you have a financial safety net to rely on during your travels.

Additional Resources

- Savings Calculators: Use online tools to calculate how much you need to save.

- Financial Planning Apps: Track your progress and stay on top of your savings goals.

Additional Tips from Top Resources

- High-Yield Savings Account: Use a high-yield savings account to earn more interest on your emergency fund (Money Under 30).

- Budget and Track: Create a detailed budget to identify how much you need to save each month for your emergency fund (Finder UK).

- Emergency Fund Basics: Start with a small goal like $1,000 and then aim to save 3 to 6 months’ worth of expenses (Fidelity).

FAQ

Why is having an emergency fund important for vacations?

Having an emergency fund provides a financial safety net for unexpected expenses during your vacation. It helps you avoid going into debt or relying on credit cards or loans.

How do I build an emergency fund?

Start by charting your monthly income and expenses, then set a savings goal to cover three to six months’ worth of living expenses. Set aside a designated amount of money regularly and keep your emergency fund in an easily accessible account.

How can I stretch my vacation budget?

Consider factors such as transportation costs, accommodation expenses, food, activities, and souvenirs. Look for ways to save, such as using rewards points, opting for less expensive options, driving instead of flying, or traveling for fewer days.

How do I balance vacation expenses with emergency savings?

Prioritize your financial security by finding a balance between enjoying your vacation and setting aside enough funds for emergencies. Personalized budgeting and careful planning are key to achieving this balance.

Why is personalized budgeting important?

Personalized budgeting allows you to allocate funds based on your priorities and financial goals. It helps you save for emergencies while also enjoying your vacation without going into debt or overspending.

Why is Budgeting Important for a Family Vacation?

Planning a budget-friendly family vacation is crucial for several reasons. First, it helps allocate funds wisely, ensuring you can afford the trip without stress. Second, budgeting allows you to prioritize expenses, ensuring you make the most of your money. Lastly, it promotes financial discipline, teaching your family valuable lessons about money management. Get started by following these budget-friendly family vacation tips.

Pingback: Spring Clean Your Finances: A Budget Refresh Guide – Straight Fire Money