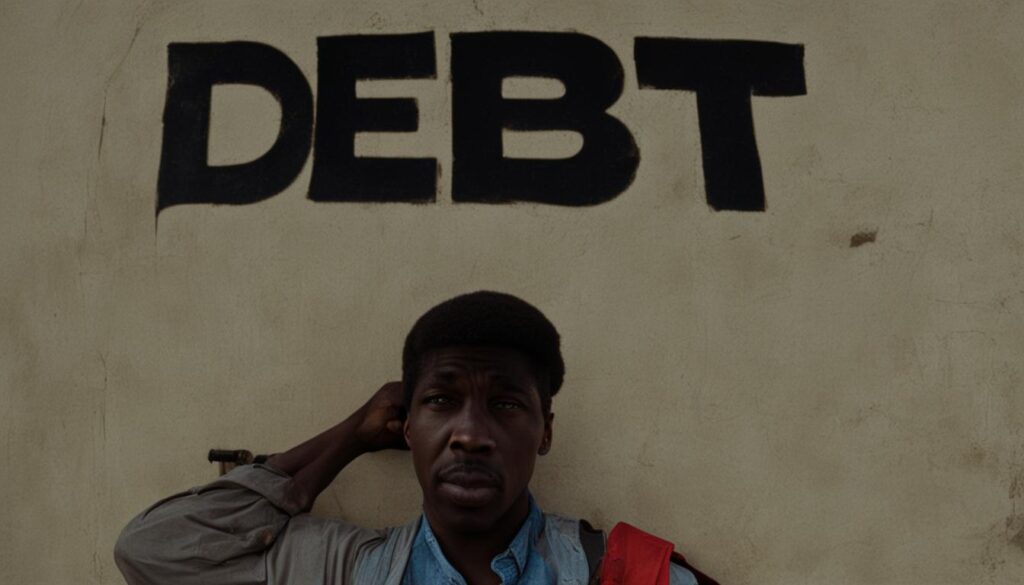

In your 20s, it’s common to experience financial fears and anxieties. However, with the right strategies, you can overcome these fears and build financial confidence for a secure future. By addressing issues such as fear of debt and fear of investing, you can navigate the world of personal finance with courage and bravery. This article will provide practical tips and insights to help you conquer your money fears and build the financial stability you desire.

Key Takeaways:

- Overcoming financial fears is essential for building financial confidence in your 20s.

- Fear of debt and fear of investing are common money fears that can be conquered through education and action.

- Managing your money effectively, creating a budget, and saving for emergencies are crucial steps towards financial stability.

- Investing in your 20s can lead to significant financial growth and wealth-building in the long run.

- Utilizing financial planning apps and focusing on financial literacy can help you overcome financial challenges and make better financial decisions.

Managing Money in Your 20s

In your 20s, managing your money effectively is crucial for building financial stability and overcoming financial fears. By implementing smart money management strategies, you can gain control over your finances and set yourself up for a secure financial future.

Creating a Budget

One of the first steps in managing your money is creating a budget. A budget helps you track your income and expenses, allowing you to see where your money is going and make necessary adjustments. Start by listing all your sources of income, including wages, side hustles, or any other sources. Next, track your expenses by categorizing them into essential expenses, such as rent and food, and discretionary expenses, such as entertainment and dining out. By assigning a specific amount to each category and sticking to it, you can ensure that you’re spending within your means and saving for your financial goals.

Saving and Investing

Another critical aspect of money management in your 20s is saving and investing. It’s essential to save a portion of your income each month to build an emergency fund and cover unexpected expenses. Aim to save at least three to six months’ worth of living expenses. Additionally, consider investing in a retirement fund or a high-yield savings account. This allows your money to grow over time and provides you with financial security in the long run. Research different investment options based on your risk tolerance and financial goals to make informed decisions.

| Money Management Tips | Action Steps |

|---|---|

| Track your expenses | Create a spreadsheet or use a budgeting app to monitor your spending habits. |

| Automate savings | Set up automatic transfers to a separate savings account to make saving effortless. |

| Limit discretionary spending | Identify areas where you can cut back on expenses, such as eating out or subscription services. |

| Maximize retirement contributions | Take advantage of employer-sponsored retirement plans and contribute the maximum amount allowed. |

By following these money management strategies in your 20s, you can pave the way for a financially stable future. Remember, it’s never too early to start building good financial habits and conquering your money fears.

Investing Tips for Young Adults

In your 20s, it’s important to start thinking about investing to set yourself up for long-term financial growth and wealth-building. Investing in your 20s can provide you with greater financial opportunities and a secure future. Here are some essential investing tips for young adults:

Educate Yourself

Prior to investing, it’s crucial to educate yourself about different investment opportunities. This includes understanding the basics of stocks, ETFs (Exchange-Traded Funds), index funds, cryptocurrencies, and other investment vehicles. Take the time to research and learn about these options, their potential risks and rewards, and how they align with your financial goals.

Assess Your Risk Tolerance

When investing, it’s important to assess your risk tolerance. Risk tolerance refers to your ability to handle potential losses and fluctuations in the market. Some investments carry higher risks but also offer higher potential returns. Consider your financial goals, time horizon, and comfort level with risk when making investment decisions.

Diversify Your Portfolio

A key strategy for investing in your 20s is to diversify your portfolio. Diversification involves spreading your investments across different asset classes, sectors, and geographic regions. This helps reduce the risk of loss and potentially increases the likelihood of achieving solid returns. A diversified portfolio may include a mix of stocks, bonds, real estate, and other investment options.

| Investment Opportunities | Potential Returns | Risk Level |

|---|---|---|

| Stocks | High | High |

| Bonds | Moderate | Low to Moderate |

| Real Estate | High | Moderate |

| Cryptocurrencies | High | Very High |

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” – Philip Fisher

By diversifying your portfolio, you can potentially reduce the impact of market fluctuations on your investments and increase the likelihood of long-term financial success.

Remember, investing is a long-term strategy, and it’s important to be patient and stay committed to your financial goals. Regularly review and adjust your investment portfolio as needed, and seek advice from a professional financial advisor if necessary.

With the right knowledge, risk assessment, and a diversified portfolio, investing in your 20s can lay the foundation for a financially secure future.

Strategies for Overcoming Financial Challenges in Your 20s

Millennials in their 20s often face unique financial challenges that can contribute to their fears and anxieties. Heavy student loan debt, high living expenses, and a competitive job market can make it difficult to achieve financial stability. However, there are strategies that can help you overcome these hurdles and build a secure financial future.

The Impact of Student Loan Debt

One of the biggest financial challenges for young adults is the burden of student loan debt. It’s important to create a repayment plan that aligns with your budget and financial goals. Consider options such as income-driven repayment plans or refinancing to lower your monthly payments. Additionally, explore opportunities for loan forgiveness programs or employer assistance, which can provide some relief from the financial strain.

Navigating High Living Expenses

Living expenses, such as rent, utilities, and groceries, can consume a significant portion of your income. To overcome this challenge, create a budget that prioritizes essential expenses and identifies areas where you can cut back. Consider living with roommates to split costs, cooking meals at home, or exploring alternative modes of transportation to save on commuting expenses. By making mindful choices and tracking your spending, you can reduce the impact of high living expenses on your financial well-being.

Thriving in a Competitive Job Market

The job market can be fiercely competitive for young adults, making it challenging to secure stable employment and achieve financial stability. To overcome this hurdle, invest in your professional development by gaining relevant skills and certifications. Network with industry professionals, attend job fairs, and leverage online platforms to explore job opportunities. Additionally, consider freelancing or side hustling to generate additional income while building valuable experience. By staying proactive and adaptable, you can navigate the job market and position yourself for long-term financial success.

| Financial Challenge | Strategies for Overcoming |

|---|---|

| Student Loan Debt | – Create a repayment plan – Explore forgiveness programs – Consider refinancing |

| High Living Expenses | – Create a budget – Identify areas to cut back – Find cost-saving alternatives |

| Competitive Job Market | – Invest in professional development – Network and explore job opportunities – Consider freelance or side hustles |

By implementing these strategies and maintaining a proactive mindset, you can overcome the financial challenges that often plague young adults in their 20s. Remember to seek guidance from financial planning apps, such as Mint or YNAB, to track your expenses, set financial goals, and stay on top of your finances. With perseverance and a solid plan, you can conquer your money fears and build a solid foundation for a secure financial future.

Conclusion

Building financial confidence in your 20s is essential for achieving financial independence and a secure financial future. By effectively managing your money, investing wisely, and overcoming financial challenges, you can pave the way for long-term financial success.

Start by creating a comprehensive budget that tracks your income and expenses, allowing you to prioritize saving and build an emergency fund. Consider investing in retirement funds or high-yield savings accounts to grow your wealth over time and take advantage of the power of compounding.

In addition, educate yourself about different investment opportunities and understand your risk tolerance. By making informed investment decisions aligned with your financial goals, you can maximize your potential for financial growth.

Lastly, tackle financial challenges head-on by using financial planning apps to track your expenses and set financial goals. Focus on improving your financial literacy and knowledge to make better financial decisions and navigate the complexities of personal finance.

Remember, your financial future is in your hands. With determination, discipline, and the right strategies, you can conquer your money fears, achieve financial independence, and secure a prosperous financial life.

FAQ

What are some common financial fears in your 20s?

Common financial fears in your 20s include fear of debt and fear of investing.

How can I manage my money effectively in my 20s?

You can manage your money effectively in your 20s by creating a budget, setting financial goals, and saving a portion of your income each month.

How important is it to build an emergency fund?

It is important to build an emergency fund that can cover at least three to six months of living expenses for financial stability.

What are some investment strategies for young adults?

Some investment strategies for young adults include educating yourself about different investment opportunities, understanding your risk tolerance, and starting early with investments.

How can I overcome financial challenges in my 20s?

You can overcome financial challenges in your 20s by utilizing financial planning apps, focusing on financial literacy and education, and implementing strategies to manage debt and expenses.

What Are Some Strategies for Young Adults to Build Wealth?

What are some strategies for young adults to build wealth? Starting early is key to a young adult’s journey to financial growth. Creating a budget, investing in stocks or real estate, and saving for retirement are all smart choices. Building a diverse portfolio and minimizing debt are crucial steps towards achieving long-term financial success.

Source Links

- https://eightify.app/summary/personal-development-and-self-improvement/mastering-your-20s-essential-tips-for-habits-lifestyle-mindset-relationships-and-finances

- https://medium.com/@goldrsh30/smart-financial-moves-money-management-tips-for-young-adults-6ab344e0d974

- https://www.linkedin.com/pulse/7-things-invest-your-20s-saniya-vardak