As you enter your 40s, it is crucial to prioritize saving and investing for your future financial goals. This is a critical time as you are entering your peak earning years and need to set yourself up for an optimal financial future. By focusing on wealth management strategies tailored to your age, you can make the most of your financial resources and work towards a secure and prosperous future.

In this article, we will explore key aspects of wealth management in your 40s, including investment and financial planning. By understanding these strategies and taking action, you can set yourself up for a comfortable retirement, financial stability, and achieve your long-term financial goals. As you navigate through your 40s, it’s crucial to reassess your risk tolerance and adjust your investment portfolio accordingly to align with your evolving financial goals. Additionally, consider the importance of diversifying your assets to mitigate potential risks while maximizing returns. As we transition into discussing wealth management in your 50s, preparing for the next phase of life will become increasingly essential, especially as retirement approaches and the need for a solid financial foundation grows.

Key Takeaways:

- Start prioritizing saving and investing for your future financial goals in your 40s.

- Focus on wealth management strategies tailored to your age to maximize your financial resources.

- Create a solid foundation for your financial future by utilizing retirement accounts and individual retirement accounts (IRAs).

- Embrace stock market exposure for long-term growth and combat inflation.

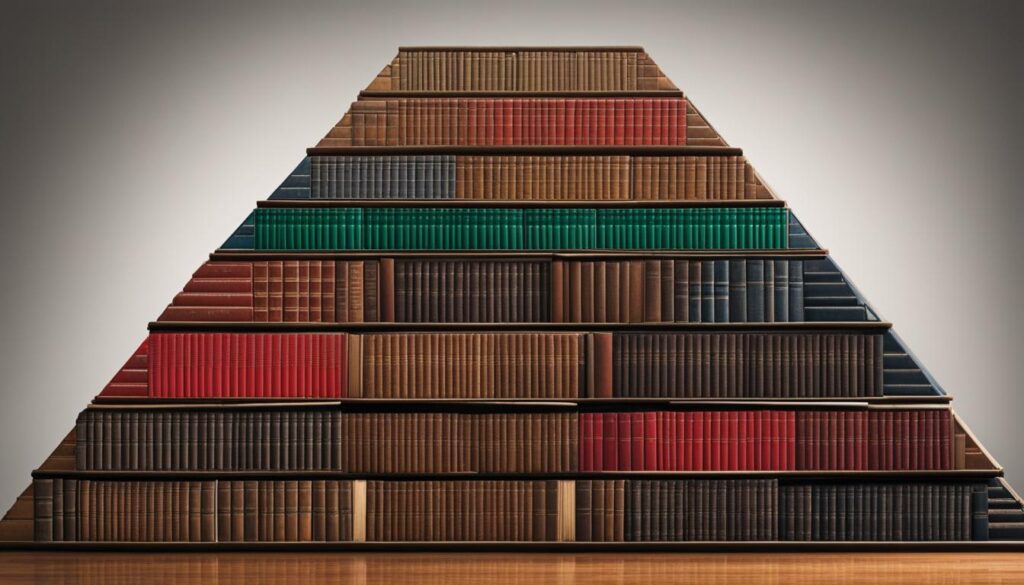

- Gain financial knowledge by reading personal finance books to develop wealth-building strategies.

Assessing Your Financial Wellness: Shine a Bright Light on Your Portfolio

To truly understand your financial wellness, it’s important to go beyond just looking at the amount of money in your portfolio. While that is certainly a significant factor, you also need to consider other key elements that will impact your future financial security. Factors like future savings, investment returns, and inflation all play a role in assessing your overall financial health.

One useful tool to help you evaluate your financial wellness is a retirement savings calculator. This calculator takes into account various factors such as your current savings, projected savings, expected investment returns, and estimated retirement age. By inputting this information, you can see if you are on track to meet your financial goals or if adjustments need to be made.

It’s important to remember that small changes can make a big difference in your future quality of life. Increasing your monthly savings even by a modest amount can add up over time and significantly impact your retirement nest egg. Similarly, working for an additional year or two before retiring can provide you with extra savings and more financial security in the long run.

| Factors to Consider for Financial Wellness | Actions to Improve Financial Wellness |

|---|---|

| Savings and Investment Returns | Regularly review and adjust your savings and investment strategy. Consider seeking professional financial advice. |

| Inflation | Factor in inflation when planning for future savings and retirement needs. |

| Retirement Age | Consider working for an additional year or two to increase your retirement savings. |

| Monthly Savings | Look for opportunities to increase your monthly savings, even by a small amount. |

Assessing Your Financial Wellness: Key Takeaways

- Financial wellness is not just determined by the amount of money in your portfolio.

- Consider using a retirement savings calculator to assess your financial health and make necessary adjustments.

- Small changes like increasing monthly savings or working for an additional year can significantly improve your future financial security.

Utilizing Individual Retirement Accounts for Future Security

As you navigate your 40s and plan for a secure financial future, one key tool to consider is an Individual Retirement Account (IRA). By opening and regularly updating your IRAs, you can lay the groundwork for a strong and stable retirement portfolio. Two popular options to explore are the Roth IRA and the Roth 401(k), which offer unique benefits for long-term financial security.

The Benefits of a Roth IRA

A Roth IRA is a tax-advantaged retirement account that allows you to contribute after-tax dollars. The biggest advantage of a Roth IRA is that qualified withdrawals are tax-free, providing potential tax-free income during retirement. Additionally, Roth IRAs offer greater flexibility in terms of early withdrawals, as contributions (not earnings) can be withdrawn penalty-free before age 59 ½.

Exploring the Roth 401(k)

If your employer offers a Roth 401(k) option, it can be a powerful addition to your retirement savings strategy. Similar to a Roth IRA, contributions to a Roth 401(k) are made with after-tax dollars. However, unlike a Roth IRA, there are no income limitations for contributing to a Roth 401(k). Additionally, Roth 401(k)s have higher contribution limits than Roth IRAs, allowing you to potentially save more for retirement each year.

When considering your retirement savings, it’s important to diversify your portfolio to manage risk. By utilizing a combination of traditional retirement accounts, such as 401(k)s or 403bs, along with Roth IRAs and Roth 401(k)s, you can achieve tax diversification. This ensures that you have a mix of taxable and tax-free income in retirement, giving you more control over your tax situation.

401(k) Rollover for Simplified Management and More Options

If you have multiple retirement accounts from previous employers, it may be beneficial to consolidate them into one IRA. This process, known as a 401(k) rollover, allows you to simplify your account management and gain access to a wider range of investment options. By consolidating your accounts, you can have a more comprehensive view of your retirement savings and make more informed investment decisions.

Table:

| Account Type | Tax Treatment | Contribution Limits (2021) | Withdrawal Rules |

|---|---|---|---|

| Roth IRA | After-tax contributions | $6,000 ($7,000 for individuals age 50 or older) | Qualified withdrawals tax-free, contributions can be withdrawn penalty-free |

| Roth 401(k) | After-tax contributions | $19,500 ($26,000 for individuals age 50 or older) | Qualified withdrawals tax-free, subject to a five-year holding period |

By utilizing Individual Retirement Accounts, such as Roth IRAs and Roth 401(k)s, you can establish a strong foundation for your financial future. These accounts offer tax advantages and the potential for tax-free income in retirement. Don’t forget to consider a 401(k) rollover if you have multiple retirement accounts from previous employers. Consolidating your accounts can simplify your financial management and provide access to a broader range of investment options. Take control of your retirement planning in your 40s and lay the groundwork for a secure and prosperous future.

Embracing Stock Market Exposure for Long-Term Growth

When it comes to building wealth in your 40s, a crucial strategy is embracing stock market exposure for long-term growth. While it’s important to balance risk and investment growth as you approach retirement age, stocks remain a vital part of your portfolio. They provide the potential for higher returns and serve as a hedge against inflation.

To ensure optimal growth, consider incorporating growth investments into your portfolio. These include stocks of companies with high growth potential, such as technology or emerging market companies. By diversifying your investments, you can mitigate risks and potentially achieve higher long-term returns.

“The stock market is a powerful wealth-building tool that should not be feared but embraced. It offers the opportunity for your investments to grow significantly over time and have the potential to outpace inflation,” said financial advisor John Smith.

One way to gain exposure to the stock market is through Vanguard target-date retirement funds. These funds automatically adjust their asset allocation to become more conservative as you approach retirement. They offer a diversified portfolio of stocks and bonds, making it a convenient option for those looking for professional management and a hands-off approach.

When determining how much stock market exposure is appropriate for you, it’s essential to consider your risk tolerance and retirement income needs. If you have a higher risk tolerance and a longer time horizon, you may be more comfortable with a higher percentage of stocks in your portfolio. However, individuals with a lower risk tolerance or closer to retirement may prefer a more conservative allocation.

In conclusion, embracing stock market exposure in your 40s can have a significant impact on your long-term financial growth. By incorporating growth investments, utilizing target-date retirement funds, and considering your risk tolerance and retirement income needs, you can make informed decisions to maximize the potential of your investments and secure a prosperous future.

The Power of Knowledge: Books That Guide Your Financial Independence

When it comes to wealth-building strategies and retirement planning, gaining financial knowledge is essential. Personal finance books provide valuable insights and practical advice that can guide you towards achieving financial independence. Here are some highly recommended books that can help you navigate the complex world of investing and make informed decisions for your financial future:

- The Little Book of Common Sense Investing by John C. Bogle: This book emphasizes the advantages of index investing and the benefits of passive management. Bogle’s straightforward approach lays the foundation for building a well-diversified portfolio.

- A Random Walk Down Wall Street by Burton Malkiel: Malkiel explores various investment strategies and dispels common myths in the world of finance. This book highlights the importance of long-term investing and provides insights on how to navigate the ever-changing stock market.

- The Only Investment Guide You’ll Ever Need by Andrew Tobias: Tobias offers practical advice on budgeting, saving, and investing. He covers a wide range of topics, including tax strategies, insurance, and real estate, making it a comprehensive guide for managing your personal finances.

- I Will Teach You to Be Rich by Ramit Sethi: Sethi focuses on helping individuals build a rich life through smart spending and strategic investing. This book provides actionable steps to automate your finances, negotiate better deals, and maximize your earning potential.

- The 4-Hour Workweek by Tim Ferriss: While not specifically focused on personal finance, this book delves into the principles of automation and time management. Ferriss shares strategies to achieve financial independence and create a lifestyle that aligns with your goals and values.

These books offer valuable insights into wealth-building strategies, investing principles, and retirement planning. By arming yourself with knowledge, you can make informed financial decisions and work towards achieving your long-term goals. Remember, financial independence is a journey, and these books can serve as your roadmap along the way.

Table: Recommended Personal Finance Books

| Book Title | Author | Key Topics |

|---|---|---|

| The Little Book of Common Sense Investing | John C. Bogle | Index investing, passive management, diversification |

| A Random Walk Down Wall Street | Burton Malkiel | Investment strategies, stock market insights |

| The Only Investment Guide You’ll Ever Need | Andrew Tobias | Budgeting, saving, investing, tax strategies |

| I Will Teach You to Be Rich | Ramit Sethi | Smart spending, strategic investing, automation |

| The 4-Hour Workweek | Tim Ferriss | Automation, time management, financial independence |

Conclusion

As you reach your 40s, it is crucial to prioritize your retirement portfolio and implement effective wealth management strategies for a secure financial future. By considering your risk tolerance, diversifying your investments, and choosing between active and passive management, you can maximize your portfolio’s potential.

Regularly reviewing and adjusting your retirement portfolio is essential to ensure it aligns with your goals and risk tolerance. Diversification is key, as it helps spread risk and can potentially enhance overall returns. Balancing stocks and bonds based on your risk appetite and retirement income needs is vital for long-term growth.

When it comes to managing your investments, you have the option of active or passive management. Active management involves selecting and managing individual stocks or funds, while passive management focuses on matching the returns of a specific market index. Both approaches have their advantages and disadvantages, so it’s important to evaluate your investment goals and preferences.

By taking these steps, you can elevate your wealth management strategies in your 40s and work towards achieving financial independence and an optimal financial future. Remember, starting early, diversifying your portfolio, and gaining financial knowledge through resources like books will contribute to your long-term success in wealth management.

FAQ

How can I assess my financial wellness?

You can assess your financial wellness by considering factors such as current and future savings, investment returns, and inflation. Using a retirement savings calculator can help you determine if you are on track to achieve your financial goals and make any necessary adjustments.

What are some options for individual retirement accounts?

Consider opening and regularly updating a Roth IRA or Roth 401(k) for tax diversification and more favorable early withdrawal rules. Additionally, take advantage of workplace retirement plans like a 401(k) or 403b. You can also consolidate multiple accounts through a 401(k) rollover into an IRA for easier management and more investment options.

Should I embrace stock market exposure in my portfolio?

Yes, it’s important to include stocks in your investment mix to ensure long-term growth and combat inflation. While the percentage of stocks should decrease over time, they can still be a valuable asset for wealth accumulation. Consider target-date retirement funds and your personal risk tolerance when determining the right balance of investments.

What are some recommended personal finance books?

“The Little Book of Common Sense Investing” by John C. Bogle and “A Random Walk Down Wall Street” by Burton Malkiel provide insights into index investing and passive management. “The Only Investment Guide You’ll Ever Need” by Andrew Tobias offers practical advice on budgeting and investing, while “I Will Teach You to Be Rich” by Ramit Sethi focuses on building a rich life through smart spending. “The 4-Hour Workweek” by Tim Ferriss explores automation and time management, which can impact personal finances.

What should I consider when building my retirement portfolio?

When building your retirement portfolio, consider your risk tolerance, diversification strategies, and investment management approach. Regularly reviewing and adjusting your portfolio, as needed, will help you work towards achieving financial independence and an optimal financial future.

What Financial Strategies can I Implement in my 40s to Achieve Midlife Reinvention?

In your 40s, implementing effective financial strategies for midlife reinvention can greatly impact your future. Prioritize saving for retirement while considering your risk tolerance and diversifying investments. Pay off high-interest debt and create an emergency fund. Seek professional guidance to assess your financial goals and make informed decisions. Start exploring new career paths or entrepreneurial ventures that align with your passions and skills. Actively managing your finances now can pave the way for a successful midlife reinvention.

Pingback: Accelerating Wealth Accumulation as You Turn 40 – Straight Fire Money