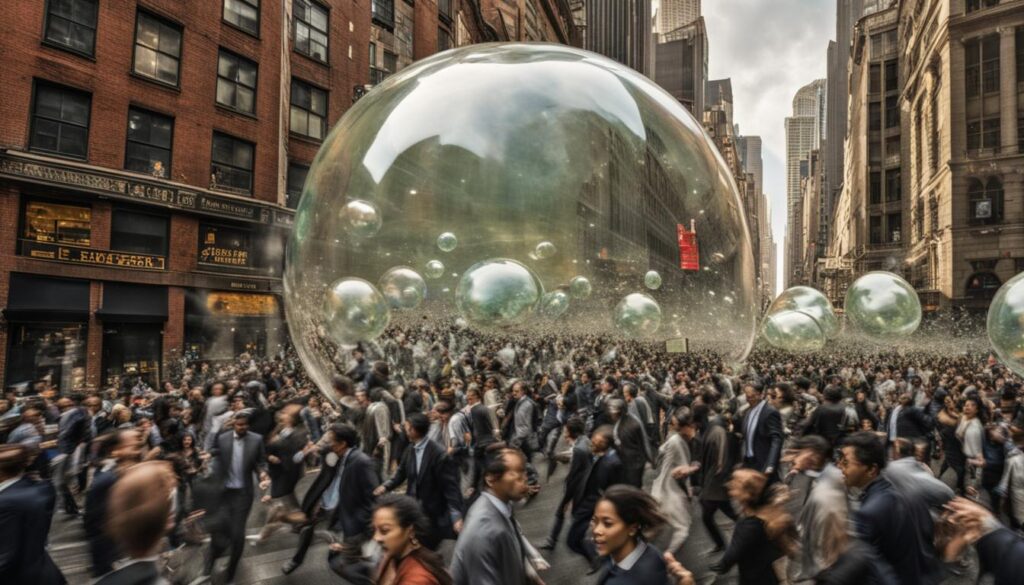

The phenomenon of herd behavior, also known as groupthink or social influence, is deeply ingrained in society and extends to the realm of investing. When it comes to making financial decisions, investors often exhibit herd behavior by following the actions of others rather than conducting their own analysis. This behavior can have significant implications for the markets, leading to asset bubbles and market crashes.

Key Takeaways:

- Herd behavior refers to the tendency of individuals to join groups and follow the actions of others.

- Investors often exhibit herd behavior in the financial sector, relying on the perceived wisdom of the crowd instead of conducting independent analysis.

- Herd behavior can lead to overvaluation or undervaluation of assets and contribute to market volatility.

- The dotcom bubble of the late 1990s is a prime example of the effects of herd behavior on market dynamics.

- Understanding the psychology behind herd behavior is crucial for investors to make informed and independent investment decisions.

What Is Herd Instinct?

Herd instinct refers to the behavior of people joining groups and following the actions of others. This behavior is particularly prevalent in the financial sector, where investors tend to follow the crowd instead of conducting their own analysis. By succumbing to herd instinct, investors may be driven by the fear of missing out on potential gains or the desire for social conformity.

Herd instinct can lead to asset bubbles and market crashes, as investors collectively make decisions based on the actions of others rather than careful analysis. One example of the significant impact of herd instinct is the dotcom bubble of the late 1990s, where investors followed the trend of investing in internet companies, leading to widespread overvaluation and subsequent market collapse.

Understanding and recognizing herd instinct is crucial in making informed investment decisions. By avoiding the temptation to blindly follow the crowd and instead conducting thorough research and analysis, investors can mitigate the risks associated with herd behavior.

The Power of Herd Instinct in the Financial Sector

Herd instinct is deeply rooted in human psychology and has a profound impact on the behavior of investors in the financial sector. When faced with uncertainty, individuals tend to seek safety and assurance by aligning their actions with the majority.

“The tendency to follow the crowd comes from a primal desire to fit in and be part of a community.”

This behavior becomes particularly pronounced in times of market volatility, as investors look to others for guidance and reassurance. As a result, market trends can be heavily influenced by the actions of the collective, leading to exaggerated price movements and the formation of investment bubbles.

By understanding the psychology behind herd instinct and its implications in investment decision-making, individuals can make more informed choices and avoid the pitfalls associated with following the crowd.

The Dangers of Herd Instinct

While herd instinct can provide a sense of security and community, it can also have detrimental effects in the financial markets. The reliance on the actions of others instead of individual analysis can lead to asset bubbles, where prices become disconnected from underlying fundamentals.

Investors who blindly follow the crowd may contribute to overvaluation or undervaluation of assets, ignoring key factors that should inform their investment decisions. The consequences of such behavior can include market volatility and potential financial losses.

Recognizing the dangers of herd instinct and actively avoiding falling into the herd mentality trap is critical. By conducting independent research, performing due diligence, and making decisions based on one’s own analysis, investors can navigate the markets with a higher level of confidence.

Overcoming Herd Instinct to Make Informed Decisions

To avoid being swayed by herd instinct, investors can implement several strategies.

- Conduct independent research: By gathering relevant information and analyzing it objectively, investors can make decisions based on their own analysis rather than following the crowd.

- Take a contrarian approach: Daring to go against the herd can provide opportunities to identify undervalued assets or uncover hidden market trends.

- Stay informed but critical: While it’s important to be aware of market trends and the actions of others, it’s equally essential to evaluate and question the rationale behind these trends.

By actively implementing these strategies, investors can avoid falling victim to herd instinct and make informed decisions that align with their investment goals and risk tolerance.

Tips to Avoid Herd Instinct

To bypass the pitfalls of herd instinct, investors can adopt several practices:

- Conduct independent research and analysis

- Diversify investments

- Set realistic goals and stick to investment plans

- Acknowledge and manage emotions

- Seek advice from trusted financial professionals

The Impact of Herd Instinct in Financial Markets

| Positive Effects | Negative Effects |

|---|---|

| Increased market liquidity | Asset bubbles and subsequent market crashes |

| Market trends influenced by collective actions | Misalignment with underlying fundamentals |

| Safe haven in times of uncertainty | Reduced individual analysis and due diligence |

| Sense of community and belonging | Market volatility |

The Psychology of Herd Instinct

Herd instinct, also known as herd behavior, is a psychological phenomenon in which individuals tend to react to the actions of others and follow their lead. This behavior is driven by a primal desire to fit in and be part of a community. In the financial context, herd instinct manifests as investors following the crowd instead of relying on their own analysis and judgment.

This tendency to react in a similar fashion to others can have significant implications for investment decisions. When investors succumb to herd instinct, it can lead to unfounded market rallies or sell-offs, causing asset prices to deviate from their intrinsic value. This behavior can contribute to market volatility and increase the risk of financial losses.

The fear of missing out on profitable investments, commonly known as FOMO, is a powerful driver of herd instinct. Investors often feel compelled to join the crowd to avoid the possibility of losing out on potential gains. Additionally, the influence of social conformity plays a role in herd instinct. The desire to conform to the actions of others and the belief that “everyone else is doing it” can override rational decision-making.

“The investment world has gone mad…. Everybody has joined in our dance,” said Sir Isaac Newton during the South Sea Bubble in 1720.

Recognizing and understanding the psychology behind herd instinct is essential for investors. By being aware of the tendency to follow the crowd and the potential pitfalls associated with it, investors can make more informed decisions. Conducting thorough research, analyzing market trends independently, and relying on one’s own judgment can help mitigate the influence of herd instinct.

Key Takeaways:

- Herd instinct refers to the behavior of people following the actions of others.

- It is driven by a desire to fit in and be part of a community.

- In investing, herd instinct manifests as investors following the crowd instead of conducting their own analysis.

- Herd instinct can lead to unfounded market rallies, sell-offs, and increased market volatility.

- Fear of missing out on profitable investments and social conformity contribute to herd instinct.

The Consequences of Herd Behavior

Herd behavior in investing can have significant consequences. When investors exhibit herd behavior, they often abandon their individual analysis and blindly follow the crowd. This can lead to overvaluation or undervaluation of assets, as prices are driven by sentiment rather than fundamentals. Herd behavior can also contribute to market volatility, as large numbers of investors pile into or exit investments based on what others are doing. Understanding the consequences of herd behavior is essential in making sound investment decisions.

When investors engage in herd behavior, they rely on the actions and decisions of others rather than conducting their own independent analysis. This can lead to a lack of critical thinking and a failure to recognize potential risks or opportunities. The overvaluation or undervaluation of assets can result in market inefficiencies, distorting prices and creating unsustainable market conditions.

Market volatility is another consequence of herd behavior. As large numbers of investors pile into or exit investments based on the actions of others, it can create abrupt and dramatic price movements. This volatility can cause significant fluctuations in market prices and make it difficult for both individual and institutional investors to accurately assess and predict market trends.

Furthermore, herd behavior can create a self-reinforcing cycle of irrational decision-making. As more investors join the herd, the momentum-driven buying or selling can push asset prices even further away from their intrinsic value. This can ultimately result in market bubbles and subsequent crashes when the sentiment reverses or reality sets in.

Consequences of Herd Behavior

| Consequence | Description |

|---|---|

| Overvaluation/Undervaluation of assets | Prices driven by sentiment rather than fundamentals can lead to distorted asset valuations. |

| Market Volatility | Large numbers of investors piling into or exiting investments based on herd behavior can result in abrupt and significant price movements. |

| Market Inefficiencies | Herd behavior can create distortions and inefficiencies in the market, making it difficult to accurately assess prices and make informed investment decisions. |

| Formation of Market Bubbles | The self-reinforcing momentum of herd behavior can lead to the formation of asset bubbles, which can eventually burst, causing significant market crashes. |

Understanding the consequences of herd behavior is crucial for investors to navigate the financial markets effectively. By recognizing the potential pitfalls of blindly following the crowd, investors can make more informed decisions based on their own analysis and research. Avoiding herd behavior and conducting independent analysis can help mitigate risks and improve long-term investment outcomes.

Herding and Investment Bubbles

Herding behavior plays a significant role in the formation of investment bubbles. These bubbles occur when the market price of an asset becomes detached from its intrinsic value. Investors driven by irrational exuberance and the fear of missing out contribute to the rapid escalation of asset prices during these bubble periods.

During a bubble, investors tend to follow the crowd rather than conducting their own analysis. This herd behavior fuels the momentum of the bubble, leading to inflated asset prices that are not sustainable in the long term.

“The market can stay irrational longer than you can stay solvent.” – John Maynard Keynes

While participating in a bubble may yield short-term profits for those who join the herd early, these bubbles eventually burst, causing market crashes and significant financial losses.

The dotcom bubble of the late 1990s and the housing bubble of the mid-2000s are prime examples of the detrimental effects of herding behavior in the formation and subsequent collapse of asset bubbles.

During the dotcom bubble, investors chased after internet-based companies with little regard for their actual profitability or sustainability. This resulted in a speculative frenzy that eventually led to the crash of many highly valued tech stocks.

Similarly, the housing bubble was fueled by the belief that real estate prices would continue to rise indefinitely. Homebuyers, driven by the fear of missing out on potential profits, rushed to buy properties at inflated prices. When the bubble eventually burst, it triggered a housing market crisis and subsequent global financial turmoil.

Understanding the role of herding behavior in the formation of investment bubbles is crucial for investors. By recognizing the signs of irrational exuberance and avoiding the temptation to join the crowd, investors can protect themselves from significant financial losses when the bubble eventually bursts.

How to Avoid Herd Behavior

To avoid falling victim to herd behavior and make independent decisions in your investments, there are certain steps you can take:

- Conduct Your Own Research and Analysis: Instead of blindly following the actions of others, take the time to gather information and analyze it critically. Make sure to rely on reliable sources and perform thorough due diligence.

- Develop Your Own Opinions: Use the data and insights you gather to form your own opinions and conclusions. Don’t solely rely on what others are saying or doing.

- Ask Questions: Be curious and ask questions about investment recommendations or popular trends. Don’t be afraid to question the herd mentality and seek further understanding.

- Critically Evaluate Actions of Others: Rather than following the crowd, evaluate the actions of others with a critical eye. Consider the rationale behind their decisions and whether it aligns with your own investment strategy.

- Take the Initiative: Be proactive in your investment approach. Instead of waiting for others to make moves, take the initiative to research and identify opportunities on your own.

- Be Daring: Don’t be afraid to deviate from the herd and explore unique investment opportunities. Taking calculated risks based on your own analysis can differentiate you from the crowd.

By implementing these strategies, you can avoid herd behavior and make independent decisions that align with your goals and risk tolerance. Remember, individual research, due diligence, and independent thinking are key to successful investing.

Examples of Herd Behavior vs. Independent Decisions

| Herd Behavior | Independent Decisions |

|---|---|

| Investing in a stock solely because everyone else is buying it. | Performing thorough analysis and investing in a stock based on its fundamental strength. |

| Selling investments in a panic during a market downturn because others are doing so. | Staying calm, evaluating market conditions, and making rational decisions based on your financial goals. |

| Following investment recommendations without questioning their validity or suitability for your portfolio. | Conducting research, asking critical questions, and making investment decisions that align with your specific needs. |

By recognizing and avoiding herd behavior, you can take control of your investment decisions and achieve long-term success in the financial markets. Don’t let the influence of others overshadow your own independent thinking and analysis.

The Impact of Herd Mentality

Herd mentality, or the tendency to follow the crowd, has a profound impact on market trends and decision-making in the financial world. In the pursuit of profit and a desire to belong, investors often succumb to the influence of herd mentality, leading to significant consequences for the market.

When investors exhibit herd behavior, they align their investment strategies with prevailing trends and popular sentiment, rather than conducting independent analysis. This behavior can result in the formation of asset bubbles, where prices detach from their intrinsic value, creating unsustainable market conditions.

One remarkable example of herd mentality’s impact on the market was the dotcom bubble of the late 1990s. During this period, investors were captivated by the promise of internet-based companies, fueling a speculative frenzy. However, when reality struck, the bubble burst, leading to the collapse of several prominent tech companies and devastating financial losses for investors.

Herd mentality also contributes to increased market volatility. As investors flock to a particular investment or asset class, the resulting imbalance in supply and demand can lead to abrupt price fluctuations. Panic selling during market downturns is another manifestation of herd mentality, as fear spreads quickly among investors, exacerbating market downturns.

Recognizing the impact of herd mentality is crucial for investors to navigate the complex and often unpredictable financial markets. By understanding and guarding against herd behavior, investors can make more informed investment decisions, reducing the risk of falling into speculative traps or being driven solely by popular sentiment.

The Impact of Herd Mentality

| Effects of Herd Mentality | Examples |

|---|---|

| Formation of asset bubbles | Dotcom bubble of the late 1990s |

| Market crashes | Housing bubble crisis in 2008 |

| Increased market volatility | Panic selling during a recession |

| Reduced individual analysis | Investors relying on popular trends without due diligence |

To further illustrate the impact of herd mentality, let’s delve into the examples listed in the table.

“The dotcom bubble of the late 1990s serves as a stark reminder of the devastating consequences that can arise from herd mentality in the market. During this period, investors were lured by the hype surrounding internet-based companies, leading to astronomical valuations. However, when reality set in, the bubble burst, wiping out trillions of dollars in market value and leaving many investors in financial ruin.”

“The housing bubble crisis in 2008 provides another example of the destructive impact of herd mentality. In the years leading up to the crisis, investors blindly followed the trend of investing in real estate, disregarding the underlying risks. When the bubble burst, the consequences were far-reaching, resulting in a global financial crisis and a deep recession.”

By recognizing the impact of herd mentality, investors can strive to make more independent, well-informed decisions. Having a solid understanding of market fundamentals, conducting thorough research, and resisting the influence of popular opinion are essential in avoiding the pitfalls of herd behavior.

How Does Market Volatility Impact Herd Behavior in Investing?

Market volatility can trigger herd behavior in investor behavior and market volatility, causing individuals to make decisions based on the actions of others rather than on independent analysis. This can amplify market movements and lead to irrational investment decisions. It’s essential for investors to remain calm and focused during periods of market turbulence.

Conclusion

In conclusion, herd behavior is a psychological phenomenon that has a significant impact on investing and market trends. Investors often exhibit herd behavior by following the actions of others instead of conducting their own analysis. This behavior can lead to asset bubbles, market crashes, and increased market volatility. Understanding the psychology behind herd behavior is crucial for investors to make more informed decisions and navigate the financial markets with confidence.

By recognizing the influence of herd behavior, individuals can take steps to avoid falling into the herd mentality trap. Conducting independent research, performing due diligence, and making decisions based on individual analysis are effective ways to avoid herd behavior in investing. It is important to ask questions, critically evaluate popular trends, and not be swayed by the actions of others.

Ultimately, by mitigating the risks associated with herd behavior, investors can make sound investment choices and achieve long-term financial success. By relying on their own analysis and understanding market trends, individuals can position themselves for success in the ever-changing world of investing.

FAQ

What is herd instinct?

Herd instinct refers to the behavior of people joining groups and following the actions of others. In the financial sector, investors tend to follow the crowd instead of conducting their own analysis.

How does herd behavior affect investors?

Herd behavior can lead to overvaluation or undervaluation of assets, as prices are driven by sentiment rather than fundamentals. It can also contribute to market volatility, as large numbers of investors pile into or exit investments based on what others are doing.

What are the consequences of herd behavior?

The consequences of herd behavior include market bubbles, market crashes, and increased market volatility. When investors blindly follow the crowd, price movements are driven by irrational exuberance and the fear of missing out.

How does herding behavior contribute to investment bubbles?

Herding behavior contributes to the rapid escalation of asset prices, driven by irrational exuberance and the fear of missing out. This detachment from intrinsic value can result in the formation of investment bubbles, which can later burst and lead to significant financial losses.

How can investors avoid falling victim to herd behavior?

Investors can avoid herd behavior by doing their own research and analysis, conducting due diligence, and making independent decisions based on their own opinions. It is also important to question and critically evaluate the actions of others.

What impact does herd mentality have on market trends?

Herd mentality shapes market behavior by influencing investment trends and decision-making. It can lead to the formation of asset bubbles, market crashes, and increased market volatility.

What is the psychology behind herd behavior in investing?

Herd behavior is a psychological phenomenon driven by the desire to fit in and be part of a community. Investors tend to react to the actions of others and follow their lead, often abandoning their individual analysis in the process.