🎧 Listen to the summary

A friendly, voice-only podcast overview of why and how peer influence shapes our money habits—and what you can do to stay in control!

Ever bought something just because a friend did? Or felt left out until you joined an investment trend you’d never heard of? Peer influence on financial behavior is everywhere—affecting the way we spend, save, and grow our money in ways we don’t always notice. Want to learn why? And more importantly, want to turn peer pressure into a superpower for good decisions? Let’s dive in!

- Discover the science and psychology behind why we copy others’ money moves

- Spot both the helpful and harmful effects of financial peer pressure

- Use practical, friendly strategies to make peer influence work for you

Key Takeaways:

- Peer influence plays a significant role in shaping financial behavior, including spending habits and investment decisions.

- Financial attitudes, financial knowledge, parental income, and social interactions all contribute to the influence of peers on financial behavior.

- Social norms and money comparison can lead to increased spending to maintain social status.

- Students are highly susceptible to peer influence on spending behavior, highlighting the importance of understanding this influence in the context of academic performance and financial management.

- Peer influence extends to investment decisions and risk-taking, with individuals being more likely to take on risks when they observe their peers doing the same.

Interactive Infographic The Psychology Spending Behavior Peer Influence & Investing Social Media Effects Positive vs. Negative Business & Cultures Self-Assessment Conclusion & FAQs

The Psychology of Peer Financial Influence

Hover/tap each node for insights on why you might copy your friends with money decisions!Social

Interactive: The Psychology of Peer Financial Influence

Hover/tap each node for insights on why you might copy your friends with money decisions!

The Psychology Behind Peer Influence

What’s really going on in our minds when money is involved? Why do we copy friends?

- Social Learning: We copy people we admire or trust, believing they know what’s best. A good friend’s investing win? Hard not to want the same!

- Normative Pressure: The “fit in” urge means we buy, save, or invest to feel accepted.

- Cognitive Dissonance: When your values and group actions clash, you feel uneasy and might “change” to remove that discomfort.

- Groupthink: Everyone in your friend group starts investing in meme stocks—should you do it too?

- Amplified by Social Media: Now the crowd is global. Peer influence spreads even faster, especially with viral money trends.

How Peer Influence Shapes Your Spending Habits

Have you ever:

- Bought branded shoes because friends did?

- Splurged on a trip after seeing Instagram posts?

- Joined a group gift, even when it didn’t fit your budget?

Personal story: “I maxed out a credit card last summer — all because ‘everyone’ was going to music festivals. Looking back, it was FOMO, not what I really wanted.”

The Impact of Peer Pressure on Spending Behavior

Peer pressure has a profound influence on the spending behavior of students. When making decisions about spending, students are highly responsive to their peers and the prevailing social norms. Studies have consistently shown that individuals tend to conform to the spending decisions of their peers in order to avoid social penalties.

One of the main reasons why peer pressure affects spending behavior is the strong desire to fit in and conform to social norms. Students often feel the need to match the spending patterns of their friends and classmates in order to be accepted and avoid feeling left out. This can lead to financial choices that are not necessarily aligned with their own financial situation or goals.

Moreover, peer pressure is not limited to just spending decisions. It has also been linked to indulgence in misbehaviors such as smoking, fighting, stealing, and truancy among students. The desire to conform to social norms and gain acceptance from peers can sometimes lead to impulsive and reckless behavior.

Decision making under peer pressure can be challenging, as individuals may prioritize social approval over their own financial well-being. This can result in poor financial choices, such as overspending, accumulating debt, or neglecting important financial responsibilities.

“I felt pressured to spend more money on clothes and accessories because all my friends were doing it. I didn’t want to be the odd one out, so I ended up maxing out my credit card.”

It is important for individuals to be aware of the influence that peer pressure can have on their spending behavior. By understanding their own financial values and goals, individuals can make more deliberate and responsible spending decisions, even in the face of peer pressure.

As educators and parents, it is crucial to teach young people about the influence of peer pressure on financial behavior and provide them with the necessary tools and support to make informed financial decisions. By fostering financial literacy and promoting independent thinking, we can empower students to resist peer pressure and develop healthy spending habits.

Examples of Peer Pressure-Induced Spending Behavior

| Examples of Peer Pressure-Induced Spending Behavior | Impact on Individuals |

|---|---|

| Buying expensive brands and luxury items to fit in with a certain social group | Significant financial strain and potential debt accumulation |

| Participating in costly social activities and events to maintain social status | Financial instability and compromised savings |

| Taking on unnecessary credit card debt to keep up with peers’ spending levels | Long-term financial burden and diminished creditworthiness |

How to handle financial peer pressure | ABS-CBN News

Peer Influence in Investing & Risk-Takinginvesting

- Social Proof: If friends invest in stocks (or meme coins!), you feel it’s safer—even when it’s riskier than you think.

- Risk Shifts: Men, especially, get more adventurous with money when friends are watching!

- Group Trends: Like dominoes, when one starts, others quickly follow. That’s why “investment bubbles” happen.

A real-world example from the “meme stock” craze: Many piled into the market “because everyone was doing it”—not always with happy outcomes. It pays to pause and ask: “Is this decision right for me?”

Peer Influence on Investment Decisions and Risk Taking

Peer influence doesn’t just shape spending behavior, but also plays a significant role in investment decisions and risk taking. Studies have consistently shown that social interaction has a direct and measurable effect on individuals’ portfolio risk exposures. When individuals observe their peers taking on more risky assets, they are more likely to follow suit.

One key finding is that individuals’ proportions of risky assets are positively correlated with the average proportions of risky assets held by their peers. In other words, if a person’s friends are investing in high-risk assets, they are more likely to take on similar risks in their own investment portfolios.

Furthermore, studies have also shown that there is a positive correlation between individuals’ choice of stock portfolio volatility and the average stock portfolio volatility among their peers. This indicates that when individuals witness their peers engaging in more volatile stock trading, they tend to mimic this behavior, resulting in riskier investment decisions.

Peer influence on risk taking tends to be stronger for less wealthy individuals, those with higher disposable income, and men. This suggests that individuals who are more financially vulnerable or have greater financial resources may be more susceptible to the influence of their peers when it comes to investment decisions and risk taking.

Overall, the evidence suggests that individuals’ investment decisions and risk taking are significantly influenced by the behavior and choices of their peers. This phenomenon highlights the important role that social interaction and peer influence play in shaping financial behavior.

| Peer Influence Factors | Impact on Investment Decisions and Risk Taking |

|---|---|

| Proportions of risky assets among peers | Positively correlated with individuals’ proportions of risky assets |

| Average stock portfolio volatility among peers | Positively correlated with individuals’ choice of stock volatility |

| Economic status (less wealthy individuals) | Stronger peer influence on risk taking |

| Disposable income (higher disposable income) | Stronger peer influence on risk taking |

| Gender (men) | Stronger peer influence on risk taking |

Financial Management Skills and Academic Performance

Effective financial management skills can have a profound impact on the academic performance of students. When students possess the necessary skills to manage their finances, they are better equipped to balance their monetary responsibilities and academic commitments, ultimately fostering a conducive environment for success.

On the contrary, students who struggle with financial management often face difficulties in juggling their financial obligations, leading to adverse effects on their academic performance. Poor budgeting practices and high levels of debt can create immense stress, distractions, and time-consuming problems that divert their focus away from their studies.

In fact, research has shown a strong correlation between financial problems and academic performance. Students burdened with significant debt and financial stress may experience lower grades, increased dropouts, and limited opportunities for personal growth and engagement in extracurricular activities.

| Financial Problems | Impact on Academic Performance |

|---|---|

| High levels of debt | Increased stress and anxiety, distraction from studies |

| Poor budgeting practices | Inability to meet educational expenses, lack of resources for academic enrichment |

Recognizing the significance of financial management skills in promoting academic excellence, universities and educators play a vital role in equipping students with the necessary knowledge and tools for effective money management. By incorporating financial literacy programs into the curriculum, educational institutions empower students to make informed financial decisions and develop responsible spending habits.

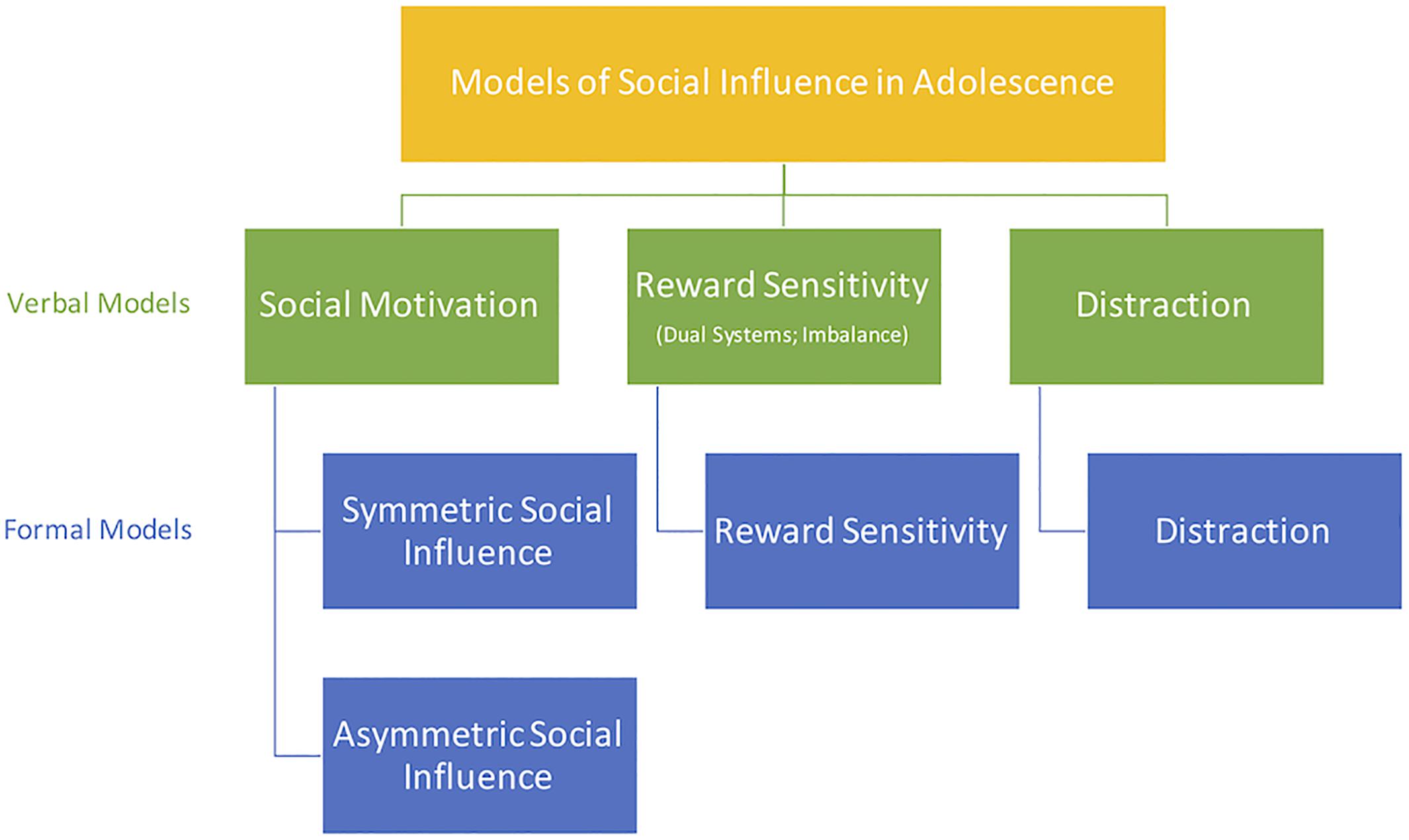

The psychology behind peer financial decisions

Adolescent risk-takers: The power of peers | Nature Video

Social Media: The Peer Pressure Supercharger

Think peer influence is just about friends? Think again. Social media puts peer money moves in your pocket — 24/7!

- Hashtag FOMO: Do you ever feel left out scrolling through fancy vacation posts?

- Influencer Culture: Recommendations aren’t always based on good advice — sometimes, they’re paid ads.

- Impulse Spending: Studies show almost half of social users have bought something just to “keep up.”

Positive vs. Negative Peer Influence

👍 Positive Examples

- Your friend uses a budget app—so you start too.

- Joining a “no spend” challenge group online helps you save.

- Friends encourage you to celebrate paying off debt instead of buying new stuff.

👎 Negative Patterns

- You feel stressed keeping up with friends’ “latest” purchases.

- Over-spending at group social events to avoid seeming out of place.

- Following “get rich quick” schemes that friends push your way.

Key tip: Choose your “money tribe” wisely. The right group can inspire you — the wrong one can drain your wallet!

Herd Behaviour explained in a minute | Sanlam Investments

Peer Influence in Business & Across Cultures

- Small businesses often mimic larger “role model” companies’ spending and investing behaviors.

- In some cultures, family influence outweighs peer influence; in others, friends take center stage.

- Generational differences: Millennials and Gen Z are more affected by online financial peer pressure, while Baby Boomers rely more on family advice.

Peer Influence on Financial Decision Making in Business

Peer influence plays a significant role in financial decision making within the business sector. Firms’ financing decisions and capital structures can be influenced by the financial choices and characteristics of their peer companies. Social influence, particularly through social learning and social utility, affects investment decisions. Moreover, peer influence also extends to firms’ payout policies, including dividends and share repurchases.

Smaller and younger firms are particularly responsive to the behavior of industry peers when making payout decisions. They tend to closely observe and mimic the payout practices of established companies in their sector. Furthermore, the influence of industry peers can also be observed in corporate disclosure decisions. Industry peers’ disclosures often induce firms to disclose information to maintain competitive parity and visibility in capital markets.

The role of peer influence in financial decision making is multi-faceted. By providing valuable information, shaping behavior, and affecting competitive dynamics, peer influence shapes firms’ financial decisions in significant ways.

Peer Influence on Financing Decisions

One aspect of financial decision making influenced by peer influence is firms’ financing decisions. Firms are more likely to follow the financing choices of their peer companies when determining their own capital structure and funding sources. This is particularly true in industries with high levels of interaction and information sharing among companies. By observing peer firms, businesses gain insights into the effectiveness of different financing strategies and can adjust their own decisions accordingly.

Peer Influence on Payout Policies

Peer influence also plays a role in firms’ payout policies, such as dividend payments and share repurchases. Smaller and younger firms are observed to be more sensitive to the payout practices of their industry peers. They often view the payout policies of established companies as benchmarks for their own decisions. Companies aim to maintain their competitive position and attractiveness to investors by aligning their payout practices with industry norms.

Peer Influence on Corporate Disclosure Decisions

Corporate disclosure decisions are also influenced by peer firms within an industry. When industry peers disclose certain information, it often prompts other firms to follow suit to maintain competitive parity and visibility in capital markets. The fear of being left behind or overshadowed by peers motivates companies to disclose relevant information, ensuring they are viewed as credible and transparent by investors and stakeholders.

📝 How Vulnerable Are You to Peer Financial Pressure?

Check all that apply:

In Conclusion: Outsmarting Peer Influence

- Be aware of where (and who) your financial habits come from

- Choose positive financial role models — both offline and online

- Set boundaries without guilt (“That looks fun, but isn’t in my budget”)

- Use easy scripts to handle money invites (“I’ll join next time, saving now”)

- Share goals with supportive friends for accountability

FAQ:

Is it possible to NEVER be affected by peer influence?

No, but you can choose the voices you listen to!

Can peer influence be good?

Yes! Your “saver friends” make it easier to build strong habits.

What’s the fastest way to take control?

Notice your triggers and practice polite, positive boundaries.

How does peer influence affect financial behavior?

Peer influence can have a significant impact on financial behavior, including spending decisions, investment choices, and risk-taking. Individuals are highly responsive to the spending habits and social norms of their peers, which can shape their own financial decisions.

What factors contribute to peer influence on financial behavior?

Several factors contribute to peer influence on financial behavior, including financial attitudes, financial knowledge, parental income, and social interactions. These factors can influence individuals' perceptions of money and their spending habits.

How does peer pressure affect spending behavior?

Peer pressure can play a significant role in spending behavior, as individuals may conform to social norms and the behavior of their peers to avoid social penalties. Observable effort to peers can lead to conformity in spending decisions, which can influence individuals' financial choices.

How does peer influence affect investment decisions and risk taking?

Peer influence can impact investment decisions and risk taking. Social interaction has been found to have a direct and measurable effect on individuals' portfolio risk exposures. Individuals' investment choices and risk-taking behaviors can be influenced by the behavior and choices of their peers.

What is the relationship between financial management skills and academic performance?

Effective financial management skills have been found to have a significant impact on academic performance. Students who are able to manage their finances well are more likely to organize their lives and time in a way that promotes good academic progress, while those who struggle with financial management may face difficulties balancing their financial responsibilities with their academic commitments.

How does peer influence affect financial decision making in business?

Peer influence plays a role in financial decision making in business. Firms' financing decisions, capital structures, and payout policies can be influenced by the financing decisions and characteristics of their peer firms. The behavior and choices of industry peers can also affect corporate disclosure decisions.

References: Financial Industry Regulatory Authority, Frontiers in Psychology, Springer Nature, FasterCapital, YouTube, TalkLife Blog, and academic open journals as cited.

Additional Thoughts:

When it comes to making financial decisions, we often like to think that we're in complete control. However, research has shown that our choices are heavily influenced by the people around us. Peer influence plays a significant role in shaping our financial behavior, from spending habits to investment decisions. Understanding the impact of peer influence is crucial for individuals, educators, and businesses alike.

In the field of behavioral finance, scholars have discovered that peer interactions, along with other factors such as financial attitudes, financial knowledge, and parental income, can greatly influence the way we handle money. Our perceptions of money, driven in part by the behavior of our peers, have a direct impact on our financial decision making. Whether consciously or not, we tend to mimic the spending habits of those around us, which can lead to both positive and negative consequences for our personal financial management.

Furthermore, social norms and money play a significant role in shaping our financial choices. We often compare ourselves to our friends and acquaintances, seeking to maintain a certain level of social status. This desire for social conformity can influence our spending behavior, often leading us to spend more to keep up with our peers. Peer pressure also plays a role, as we may feel the need to conform to the spending habits of our friends in order to fit in.

As we delve deeper into the influence of friends on our spending habits, it becomes clear that peer pressure can have a powerful impact on our financial behavior. Students, in particular, are highly susceptible to the influence of their peers. Research has shown that financial attitudes, financial knowledge, parental income, and peer interactions all contribute to students' spending behavior. This highlights the importance of understanding peer influence in the context of academic performance and financial management.

Similarly, peer influence extends to investment decisions and risk-taking. Studies have found that social interaction plays a significant role in shaping individuals' investment strategies. We are more likely to take on portfolio risks when we observe our peers doing the same. This influence is particularly strong for individuals with higher disposable income and those who are less wealthy. Understanding the impact of peer influence on investment decisions can help individuals make more informed choices and manage their financial risks effectively.

Overall, peer influence has a profound impact on our financial decision making. From spending habits to investment choices, the behavior of our peers shapes our own financial behavior. Recognizing the role of peer influence is essential for individuals, educators, and businesses looking to promote smarter money management and make informed financial decisions.