The 50/30/20 rule is a simple way to manage your money. It helps you control your spending and reach your financial goals. Let’s break it down in a way that’s easy to understand and use in your daily life.

50/30/20 Budgeting Rule: Key Points

- 50% for Needs: Essential expenses like housing, food, and utilities

- 30% for Wants: Non-essential but enjoyable expenses

- 20% for Savings: Money set aside for future or debt repayment

- Flexible: Can be adapted to different financial situations

- Balanced: Allows for saving while still enjoying life

- Simple framework to manage after-tax income

- Helps prioritize essential expenses and consistent savings

- Average U.S. personal savings rate: 3.4% (June 2024)

- Ideal for those with consistent income

- May need adjustments for high-cost living areas

What is the 50/30/20 Rule?

The 50/30/20 rule is a way to split up your money after you get paid. It’s like dividing your allowance into different piggy banks. Here’s how it works:

The 50% – Your Needs

Half of your money goes to things you can’t live without. These are called “needs.” Imagine you’re building a house – these are the foundation and walls. Without them, the house would fall down. Your needs include:

- A place to live (rent or mortgage)

- Food to eat (groceries and basic meal essentials)

- Water and electricity (utilities)

- Basic clothes (not designer or luxury items)

- Transportation to school or work (public transit or basic car expenses)

- Health insurance and essential medical care

- Minimum debt payments (to avoid defaults or legal issues)

- Basic phone and internet services (for work and essential communication)

Sometimes, it’s hard to tell if something is a need or a want. A good rule is to ask, “Can I live without this?” If the answer is yes, it’s probably a want. Learn more about managing your needs during tough times, as prioritizing these expenses becomes even more crucial when resources are limited.

The 30% – Your Wants

This part of your money is for things that make life more fun and enjoyable. Think of it as the decorations on your house – they make it look nice, but you don’t really need them to have a functional home. Your wants might include:

- Going to the movies or other entertainment venues

- Buying video games, books, or hobby supplies

- Eating out at restaurants or ordering takeout

- New clothes (beyond the basics) or fashion accessories

- Vacations and travel expenses

- Streaming services like Netflix, Hulu, or Spotify

- Gym memberships or fitness classes

- Home decor and non-essential furnishings

- Gifts for friends and family

- Upgraded versions of necessities (e.g., a fancier car or phone)

It’s okay to spend money on things you enjoy. The trick is not to go overboard. Check out these tips for balancing fun and saving in your 30s, which can help you make smart choices about spending while still working towards your financial goals.

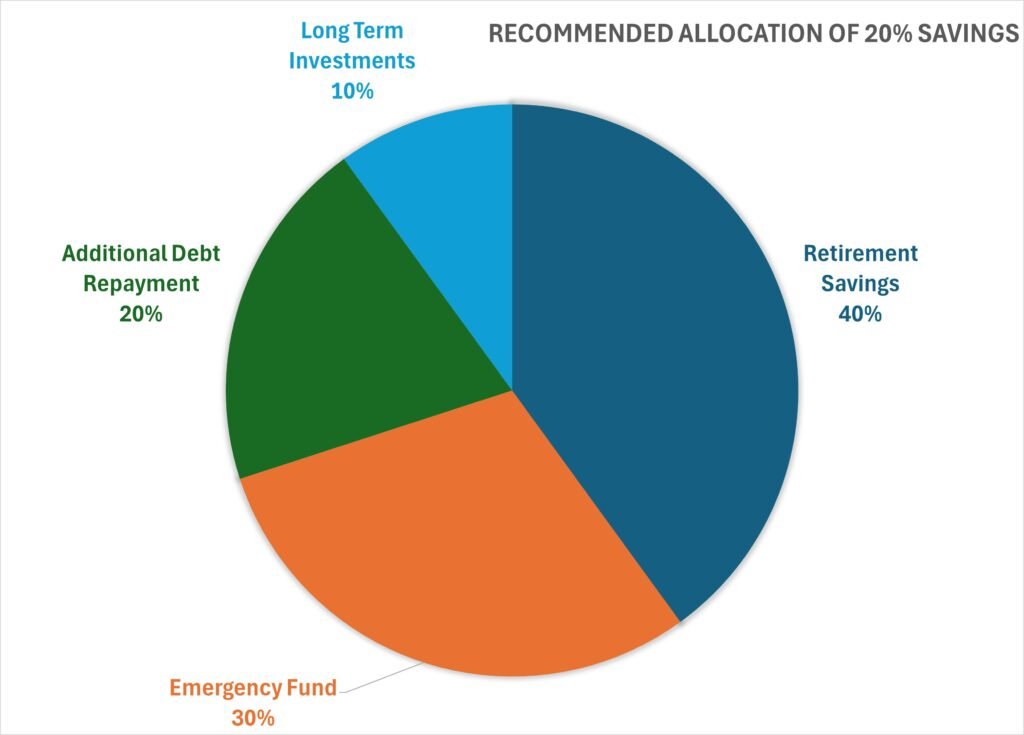

The 20% – Your Savings

This is the money you save for later or use to pay off debts. It’s like planting seeds that will grow into a big tree, providing financial security and opportunities in the future. Your savings can help you:

- Be ready for surprises (like unexpected repairs or medical expenses)

- Save for big things you want in the future (like buying a house or starting a business)

- Pay off money you owe (beyond minimum payments to reduce debt faster)

- Have money when you’re older and don’t work anymore (retirement savings)

- Invest in your education or career development

- Build wealth through investments in stocks, bonds, or real estate

- Create a financial cushion for peace of mind

Recommended Allocation of 20% Savings

Saving might not seem fun now, but it’s super important for your future. Even small amounts saved regularly can grow a lot over time. Learn how to pay off debts faster with the snowball method, which can be a good way to use your savings.

How to Use the 50/30/20 Rule

Using this rule is like following a recipe for financial success. Here’s how to do it:

- Figure out how much money you get after taxes (your take-home pay)

- Calculate the exact amounts for each category: 50%, 30%, and 20% of your take-home pay

- Review your current spending and categorize each expense as a need, want, or savings

- Compare your current spending to the ideal 50/30/20 allocation

- Adjust your spending habits to align more closely with the rule

- Set up separate bank accounts or use budgeting apps to track each category

- Automate transfers to your savings and debt repayment accounts

- Regularly review and adjust your budget to stay on track

- Be flexible and make adjustments as your financial situation changes

It might take some practice, but you’ll get better at it over time. Check out this guide on combining the 50/30/20 rule with other money tricks like the debt snowball method to improve your finances faster.

Why the 50/30/20 Rule is Good

This rule is great because:

- It’s simple to understand and use, even for beginners

- You can still buy fun things and enjoy life while saving

- It helps you save without thinking too hard about every purchase

- You can change it if you need to, making it work for different situations

- It creates a balanced approach to spending and saving

- It helps prevent overspending as you earn more

- It encourages thinking about how you use your money

- It can reduce stress about money by giving you a clear plan

- It helps you build wealth over time while meeting your current needs

When the 50/30/20 Rule Might Be Hard

Sometimes, this rule can be tricky to follow. For example:

- If you live in a very expensive city with high housing costs

- If you don’t make a lot of money and struggle to cover basic needs

- If you have a lot of debts to pay off, especially high-interest debt

- If you have irregular income, such as freelancers or seasonal workers

- If you’re dealing with a financial emergency or unexpected expenses

- If you’re saving for a big short-term goal, like a down payment on a house

- If you have dependents or additional family responsibilities

Don’t worry if it doesn’t work perfectly for you right away. You can always adjust the numbers to better fit your situation. Here are some tips for dealing with debt while budgeting, which can help if you’re struggling to balance debt repayment with other expenses.

Making the 50/30/20 Rule Work for You

Everyone’s life is different, so you might need to change this rule to fit your situation. Here are some ways you can adapt it:

- Maybe you need 60% for needs and only 20% for wants in a high-cost area

- You might put 30% to savings if you’re trying hard to pay off debt

- In tough times, you could temporarily reduce wants to 20% or less

- If you have a high income, you might be able to save more than 20%

- For irregular income, use percentages of each paycheck rather than fixed amounts

- Adjust the rule as your life and financial goals change

It is important to have a plan and stick to it, while being flexible enough to change when needed. Learn how to mix the 50/30/20 rule with other money strategies like Dave Ramsey’s Baby Steps to create a financial plan that works best for you.

Tools to Help You Budget

You don’t have to do all this math in your head. There are many tools to help you use the 50/30/20 budget:

- Budgeting apps like Mint, YNAB, or Personal Capital that sort your expenses automatically

- Spreadsheet templates made for the 50/30/20 rule (in Excel or Google Sheets)

- Special piggy banks or money jars with three slots for cash

- Envelope systems for sorting cash into different categories

- Multiple bank accounts to separate funds (one for needs, one for wants, one for savings)

- Automatic transfers in your online banking to move money to savings

- Budgeting features offered by many banks and credit card companies

- Financial planning software for more detailed money management

Using the 50/30/20 Rule as You Grow Up

As you get older, how you use the 50/30/20 rule might change. Your money priorities will be different at different ages:

- In your 20s, you might focus on paying off student loans and starting an emergency fund

- In your 30s, you might save more for a house down payment or starting a family

- In your 40s and 50s, you might increase retirement savings and save for kids’ college

- In your 60s and beyond, you might adjust the rule for less income and more healthcare costs

The rule can grow and change with you, giving you a consistent way to manage money throughout your life. As you earn more, try to save more instead of just spending more. Check out how to use the 50/30/20 rule as you get older, especially for keeping your wealth safe and planning for retirement.

Wrapping It Up: Why the 50/30/20 Rule is Great

The 50/30/20 rule is a good way to start managing your money. It’s easy to understand, flexible, and helps you balance having fun now with saving for later. Even if you can’t follow it exactly, just trying to use this rule can help you think more about how you use your money. Start small, be patient with yourself, and you’ll get better at managing your money over time.

50% Needs

Half of your income goes to essential expenses like housing, utilities, and groceries.

30% Wants

Set aside 30% for non-essential items and experiences you enjoy.

20% Savings

Dedicate 20% to savings, debt repayment, and investments for your future.

Ready to take your money skills to the next level? The 50/30/20 rule is just the start of your money journey. As you get better at budgeting and saving, you can learn more advanced ways to manage your money. Learn about how you can work towards retiring early and being financially free. This guide will help you build on what you’ve learned from the 50/30/20 rule to reach bigger financial goals.