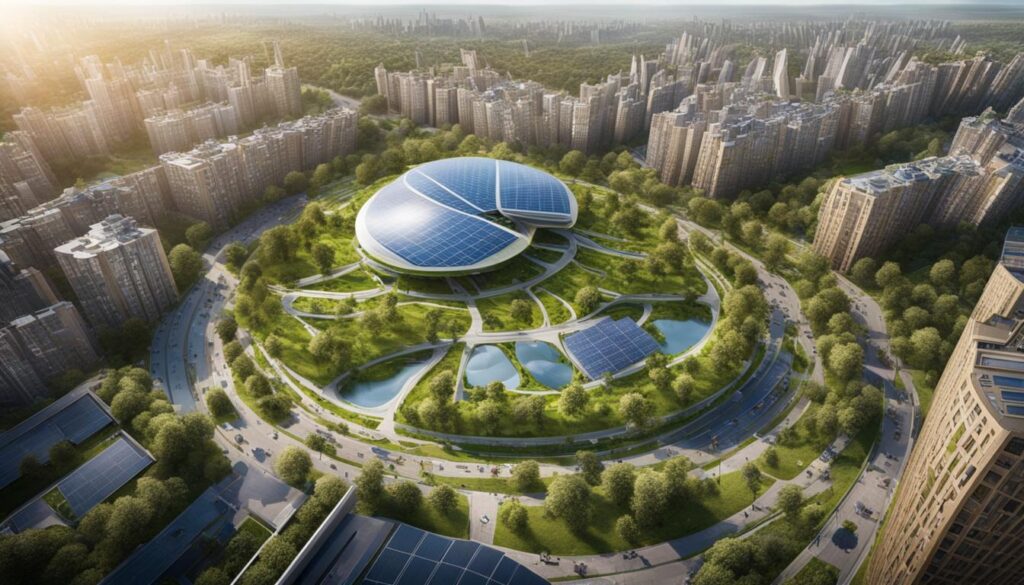

Ethical real estate investing is gaining attention as investors seek ways to enhance their portfolios while promoting sustainability and integrity. The traditional perception of real estate as a stable investment is supported by statistics, with more Americans choosing real estate as the best long-term investment according to a Gallup Poll. However, ethical concerns arise from the negative impact of the building industry on the environment and communities. This has led to a growing interest in ethical investing, with authors like Michael Shuman and Janine Firpo providing tips and insights into investing in a way that aligns with personal values. Companies like Open Path Investments and Kasaba are examples of developers who prioritize community impact and regeneration in real estate projects. The use of real estate investment trusts (REITs) and fractional ownership special purpose vehicles has also emerged as a way to overcome challenges such as lack of liquidity and maintenance hassles in real estate investing. By combining impact-driven investment strategies with innovative housing models like collective living and flexible ownership, ethical real estate investing offers the potential for positive change in both financial returns and social/environmental impact.

Key Takeaways:

- Ethical real estate investing aligns financial goals with sustainability and integrity.

- Authors like Michael Shuman and Janine Firpo provide insights into investing with personal values.

- Companies like Open Path Investments and Kasaba prioritize community impact and regeneration.

- Real estate investment trusts (REITs) and fractional ownership vehicles overcome liquidity and maintenance challenges.

- Impact-driven investment strategies and innovative housing models enhance the potential for positive change.

The Changing Landscape of Real Estate Investing

Real estate investing has undergone a significant transformation in recent years, thanks to the advent of crowdfunding and tech platforms. These innovations have revolutionized the industry, making it more accessible to individual investors and democratizing investment opportunities that were once limited to the ultra-wealthy.

Ethical investing has also gained momentum, driven by a growing awareness of the impact of investment choices on the environment and society. With concerns about carbon emissions, speculation, gentrification, and colonization, investors are increasingly seeking ways to align their investments with their values.

“Real estate investing has become more accessible to individuals in the developed world, thanks to crowdfunding laws and technology platforms.”

Homelessness has reached alarming levels in many American cities, highlighting the urgent need for a more responsible approach to real estate investment.

This changing landscape has paved the way for innovative approaches to ethical real estate investing, where investors can align their financial goals with their ethical principles. By leveraging crowdfunding and tech platforms, individuals can now participate in projects that promote sustainability, community development, and social impact.

Overall, the combination of technological advancements, increased accessibility, and a growing awareness of ethical investing has transformed the real estate investment landscape. Investors now have the opportunity to make a positive impact while achieving their financial goals.

Overcoming Challenges with REITs and Fractional Ownership

Traditional real estate investing comes with its fair share of challenges, including liquidity issues and the burden of property maintenance. However, these challenges can be effectively mitigated through the use of real estate investment trusts (REITs) and fractional ownership special purpose vehicles. These innovative investment options provide solutions that make ethical investing in real estate more accessible and convenient for investors.

Real Estate Investment Trusts (REITs): REITs allow investors to enter the real estate market with smaller amounts of capital and offer the flexibility to sell shares at any time. By pooling funds from multiple investors, REITs provide greater liquidity compared to direct property ownership. Additionally, REITs are managed by professionals who handle property management and maintenance, relieving investors of these responsibilities.

Fractional Ownership: Fractional ownership models enable investors to co-own a property and share the responsibilities of property management. This approach allows investors to diversify their investments across multiple properties and benefit from professional property management services. Fractional ownership is particularly suited for investors who want to enter the real estate market with lower entry amounts, while still enjoying the potential financial returns and the convenience of fully-managed investments.

Through the use of REITs and fractional ownership, ethical real estate investing becomes more inclusive and less burdensome for investors. These investment options address the challenges of liquidity and property maintenance, allowing investors to focus on the positive impact they can make through their investments in sustainable and socially responsible real estate projects.

Overcoming Challenges with REITs and Fractional Ownership

| Traditional Real Estate Investing | REITs | Fractional Ownership | |

|---|---|---|---|

| Entry Amounts | High | Lower | Lower |

| Liquidity | Low | High | Medium |

| Maintenance | Investor’s responsibility | Managed by professionals | Shared responsibility |

The table above highlights the key differences between traditional real estate investing, REITs, and fractional ownership. While traditional real estate investing requires high entry amounts, offers low liquidity, and burdens investors with property maintenance, REITs and fractional ownership provide lower entry amounts, higher liquidity, and shared or professional property management. These options allow investors to overcome the challenges associated with traditional real estate investing and engage in ethical investing with greater convenience and flexibility.

The Rise of Ethical Real Estate Projects

Ethical real estate projects are gaining traction as impact-driven investing becomes a priority for many investors, including high net worth individuals. These projects offer a two-fold approach, delivering both financial returns and community optimization. Companies like Open Path Investments and Kasaba are leading the way in this emerging field, providing opportunities for investors to make a positive impact while achieving their financial goals.

Open Path Investments, founded by Gina Borges, focuses on connecting high net worth individuals with multifamily developments that prioritize community optimization over profit maximization. By investing in these projects, investors can contribute to sustainable urban development and support initiatives that regenerate and uplift communities.

Kasaba, on the other hand, offers high net worth individuals the opportunity to invest in impactful real estate developments with expected internal rates of return (IRR) of 10-15%. In addition, Kasaba invites community members to own their own tiny homes, which can be managed and provide passive income when not in use. This innovative approach combines fractional ownership and real estate investment trusts (REITs) to provide investors with flexible choices and ownership opportunities.

The Benefits of Ethical Real Estate Projects

Investing in ethical real estate projects not only allows investors to align their values with their investments but also provides the potential for attractive financial returns. These projects prioritize social and environmental impact, offering investors a way to contribute to positive change while enjoying the benefits of decentralized living. By embracing concepts like collective living and flexible choices, ethical real estate projects pave the way for innovative housing models that promote sustainability and community regeneration.

Table: Ethical Real Estate Projects Comparison

| Company | Investment Opportunity | Expected IRR | Ownership Model |

|---|---|---|---|

| Open Path Investments | Multifamily developments emphasizing community optimization | N/A | REITs and fractional ownership |

| Kasaba | Impactful real estate developments with tiny home ownership | 10-15% | REITs and fractional ownership |

As investors increasingly seek opportunities that deliver both financial returns and positive social/environmental impact, ethical real estate projects provide a compelling investment option. With their emphasis on impact-driven investing, companies like Open Path Investments and Kasaba are leading the way in creating a more sustainable and community-centered real estate landscape.

Conclusion

Ethical real estate investing offers a secure and impactful way for investors to make a positive difference while achieving financial returns. By investing in ethical real estate projects, investors can enjoy the benefits of secure investments backed by tangible assets and long-term value preservation.

The use of real estate investment trusts (REITs) and fractional ownership models simplifies the investing process, making it more accessible and convenient for individuals looking to engage in ethical real estate investing. These innovative investment vehicles provide liquidity and eliminate the hassles of property management, allowing investors to focus on the financial and social impact of their investments.

Ethical real estate investing also aligns with the mission of creating regenerative and community-centered projects. By considering the principles of decentralized finance, investors can contribute to sustainable urban development and support initiatives that prioritize the well-being of communities and the environment.

With the integration of technologies like blockchain and the expertise of hospitality and property management professionals, ethical real estate investing offers simplified investing opportunities that ensure both financial returns and a positive impact. By actively seeking out ethical investment opportunities, individuals can play a role in building a better future through their real estate investments.

FAQ

What is ethical real estate investing?

Ethical real estate investing refers to the practice of investing in real estate projects that prioritize sustainability, social impact, and community regeneration alongside financial returns.

Why is ethical real estate investing gaining attention?

Ethical real estate investing is gaining attention as investors become more aware of the negative impact of traditional real estate on the environment and communities. It provides an opportunity to align personal values with investment choices.

What are the challenges of traditional real estate investing?

Traditional real estate investing can be challenging due to issues such as lack of liquidity and the burden of property maintenance.

How can REITs and fractional ownership help overcome challenges in real estate investing?

REITs (real estate investment trusts) allow investors to enter the real estate market with smaller amounts of capital and offer the flexibility to sell shares at any time. Fractional ownership models enable investors to co-own a property and share the responsibilities of property management.

Can you provide examples of ethical real estate projects?

Open Path Investments and Kasaba are examples of companies that prioritize community impact and regeneration in real estate projects. They utilize innovative models like fractional ownership and REITs to provide ethical investment opportunities.

What are the benefits of ethical real estate investing?

Ethical real estate investing offers asset-backed opportunities, long-term value preservation, and the ability to support impactful initiatives that contribute to a regenerative and community-centered mission.

What Are Some Ethical Ways to Invest in Your Community’s Future?

Investing ethically in your community‘s future entails supporting local businesses, promoting environmental sustainability, and contributing to social causes. By patronizing local shops and services, you ensure that money stays within your community, fostering economic growth. Additionally, choosing eco-friendly initiatives and socially responsible investments can help create a more sustainable and equitable future for everyone.